Group

Bookings

Group

Bookings

Platform

Web & app

Team

1 PD 👋, 1 UX Writer, 1 MM,

2 PM, 4 Eng.

1 PD 👋, 1 UX Writer,

1 MM, 1 PM, 4 Eng.

Timeline

Nov 2025 - Present

This case study needs room to breathe. Please switch to bigger screen :)

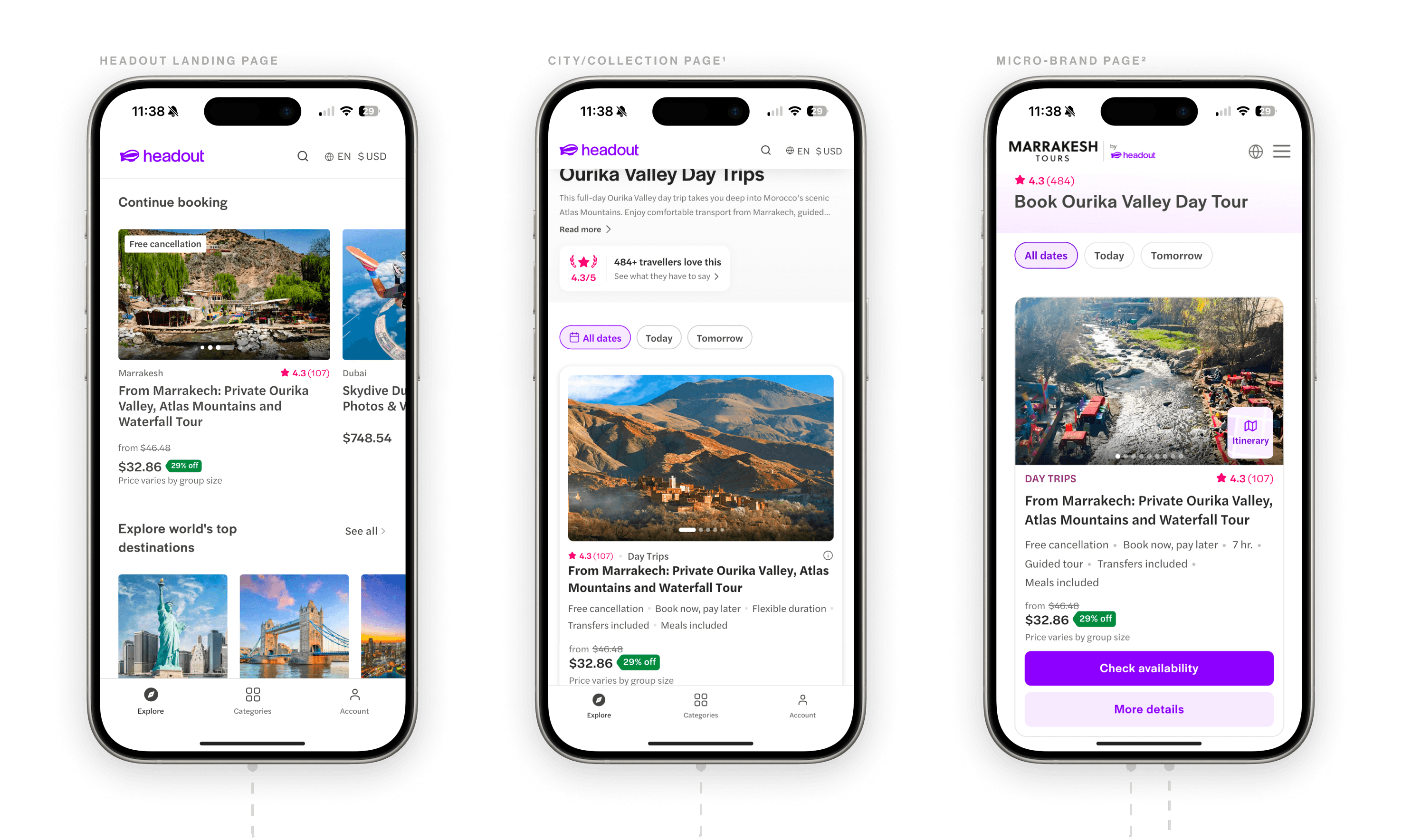

Headout is a global online managed marketplace for instantly booking local experiences, tours, and attractions, helping travelers reduce the complexity in making choices.

This case study needs room to breathe. Please switch to bigger screen :)

Claustrophobia!

How I tried to simplify Headout group booking experience to improve Select to Checkout conversion

How I tried to simplify Headout group booking experience to improve Select to Checkout conversion

Timeline

A rough estimation of the project timeline. It is still on-going

Background

Africa is an upcoming market for Headout, and most of the experiences there are for groups. Even though Headout currently has limited listed group experiences, the goal was to optimize the experience for the upcoming market.

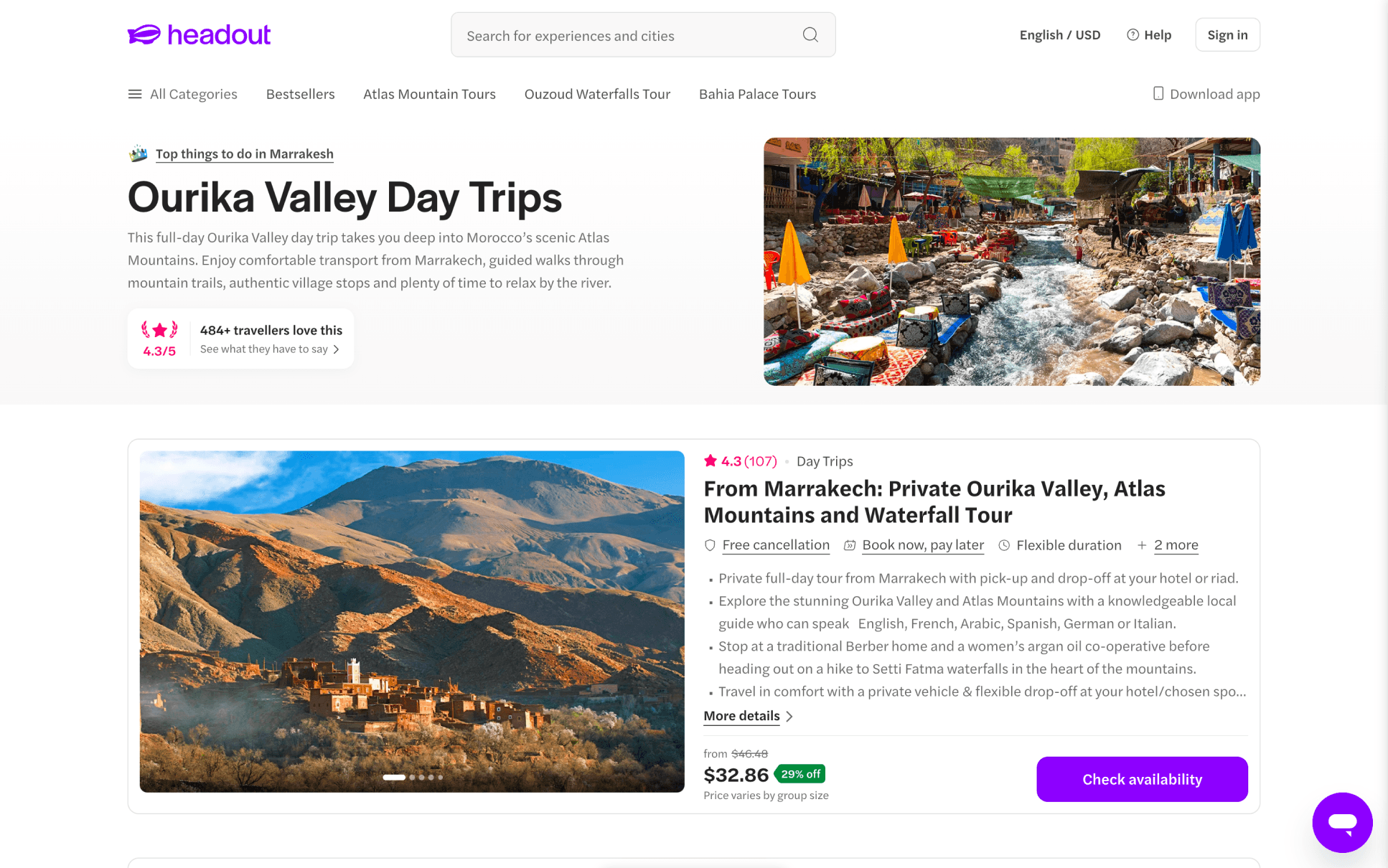

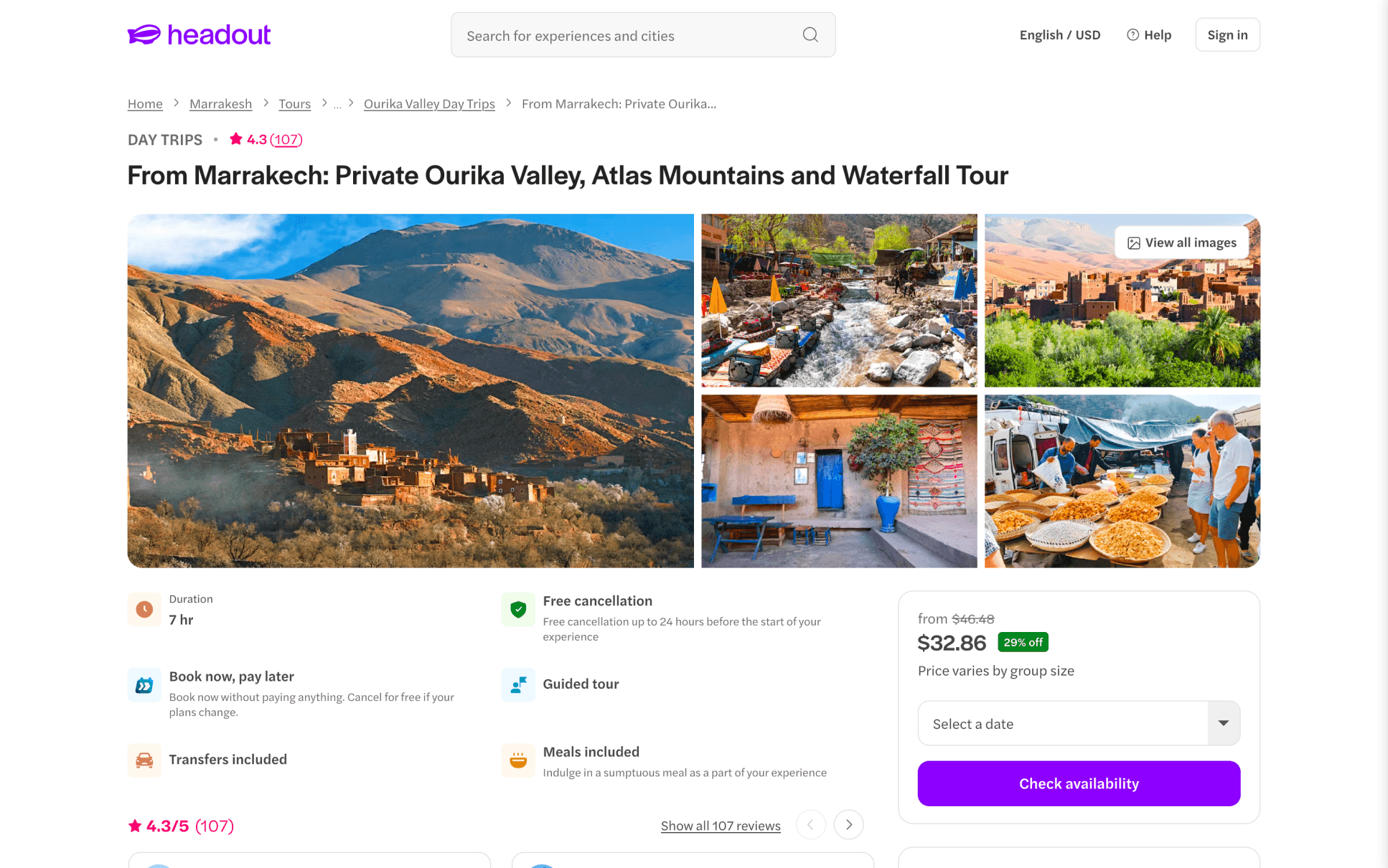

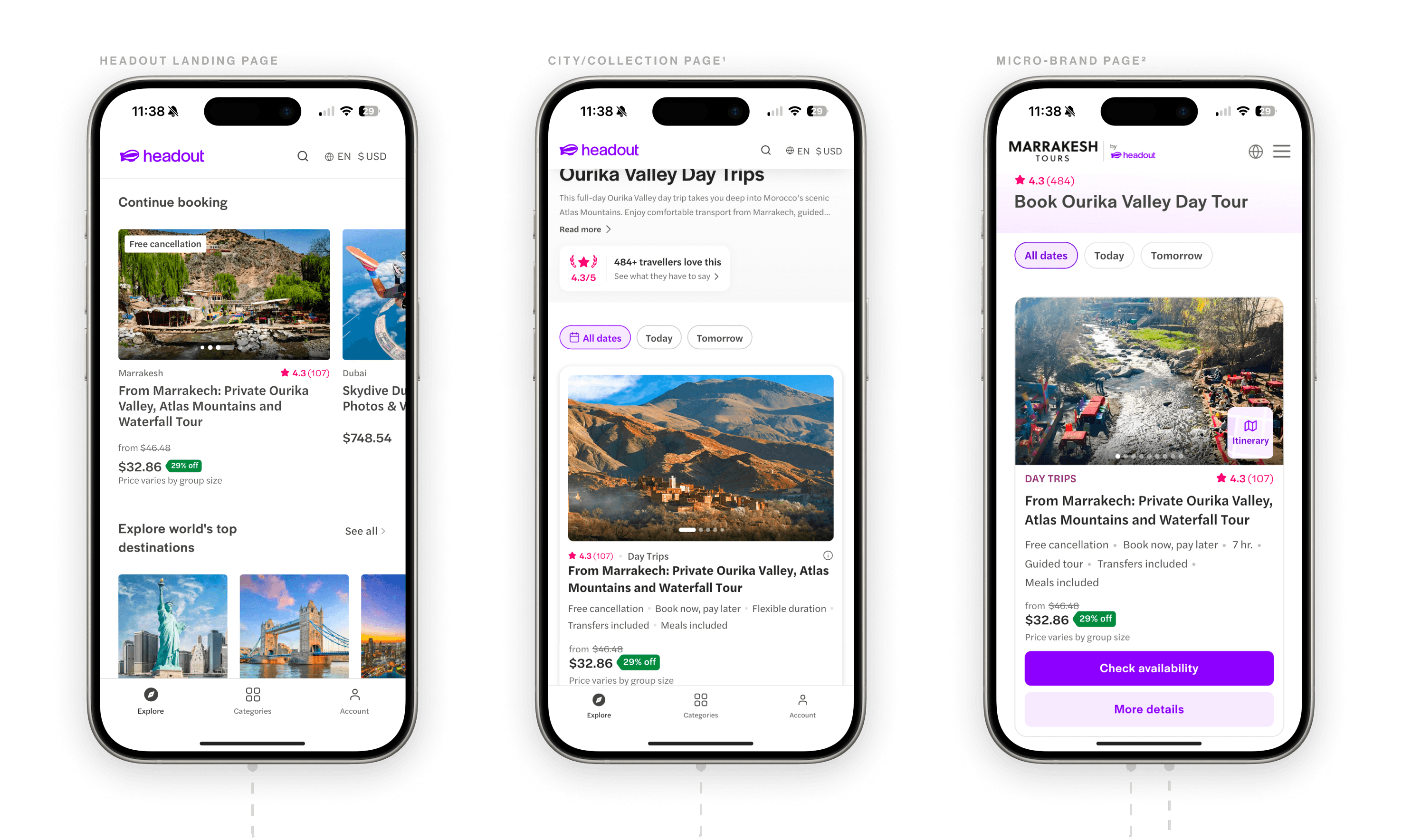

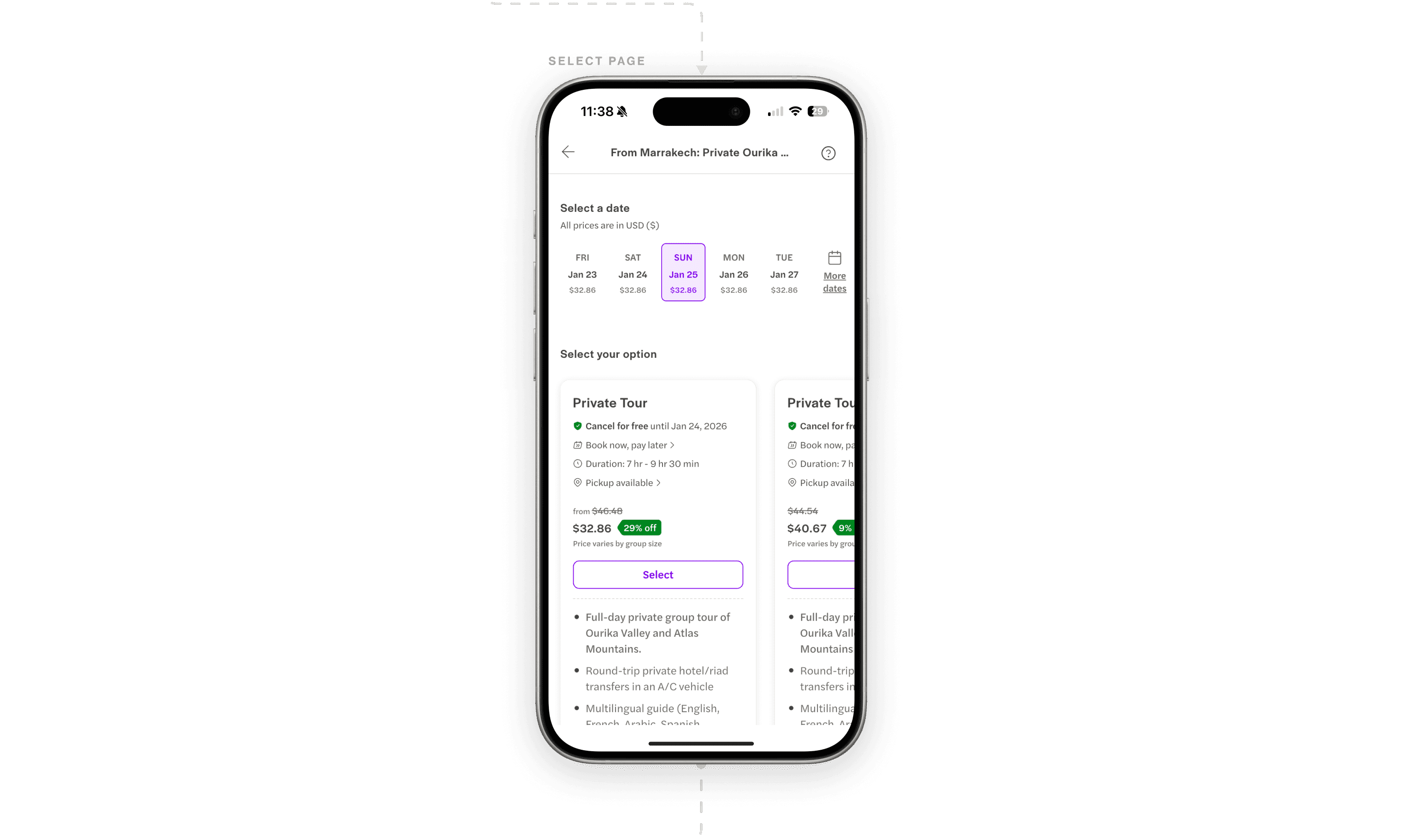

A regular experience

As a managed marketplace, Headout clubs similar experiences together, so that user’s have a narrowed decision making process.

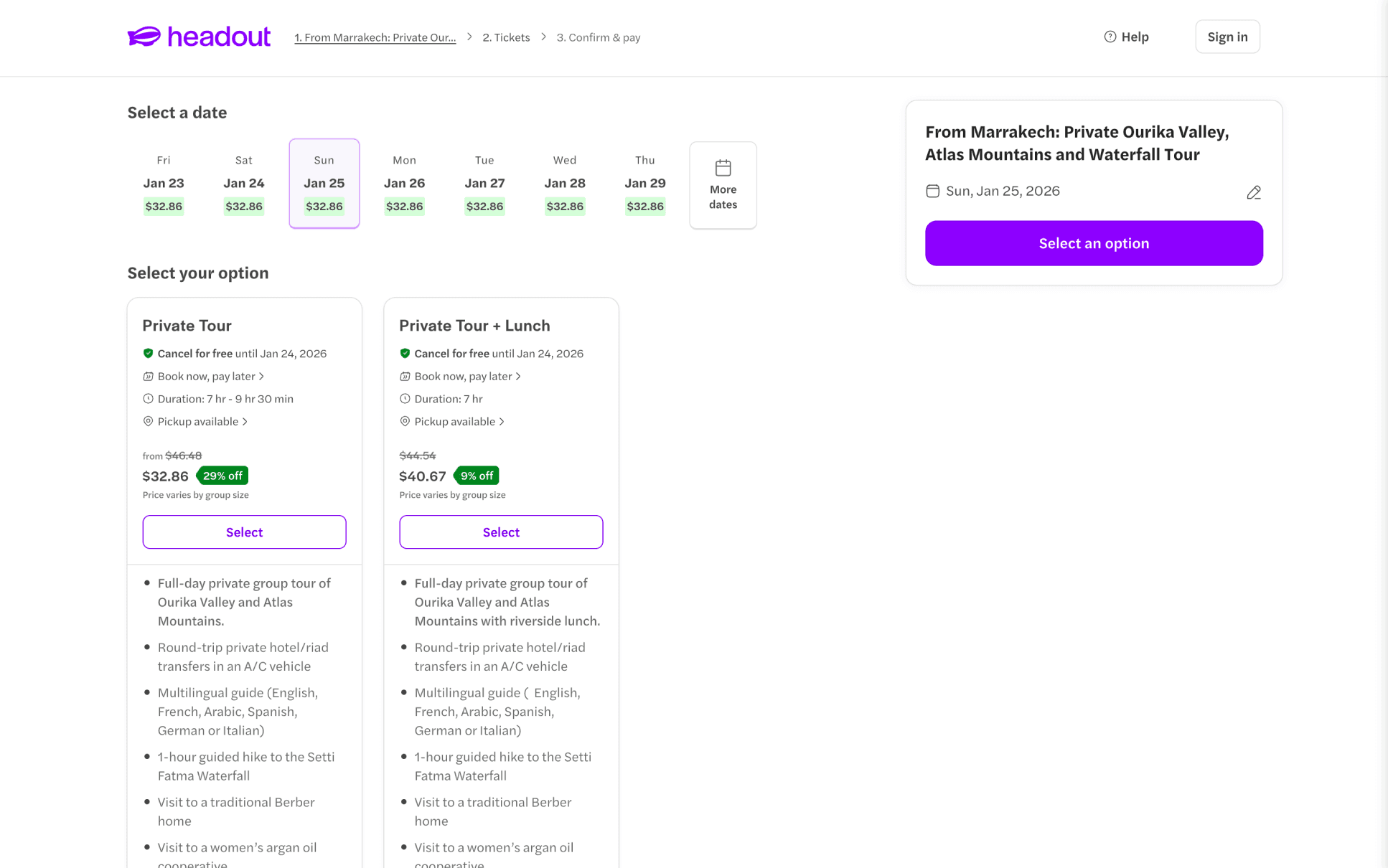

A group experience

Group bookings come in various types and pax sizes based on the vendor, hence the regular approach did not fit well here.

Group types

All the group bookings that we list can be classified into 3 major brackets.

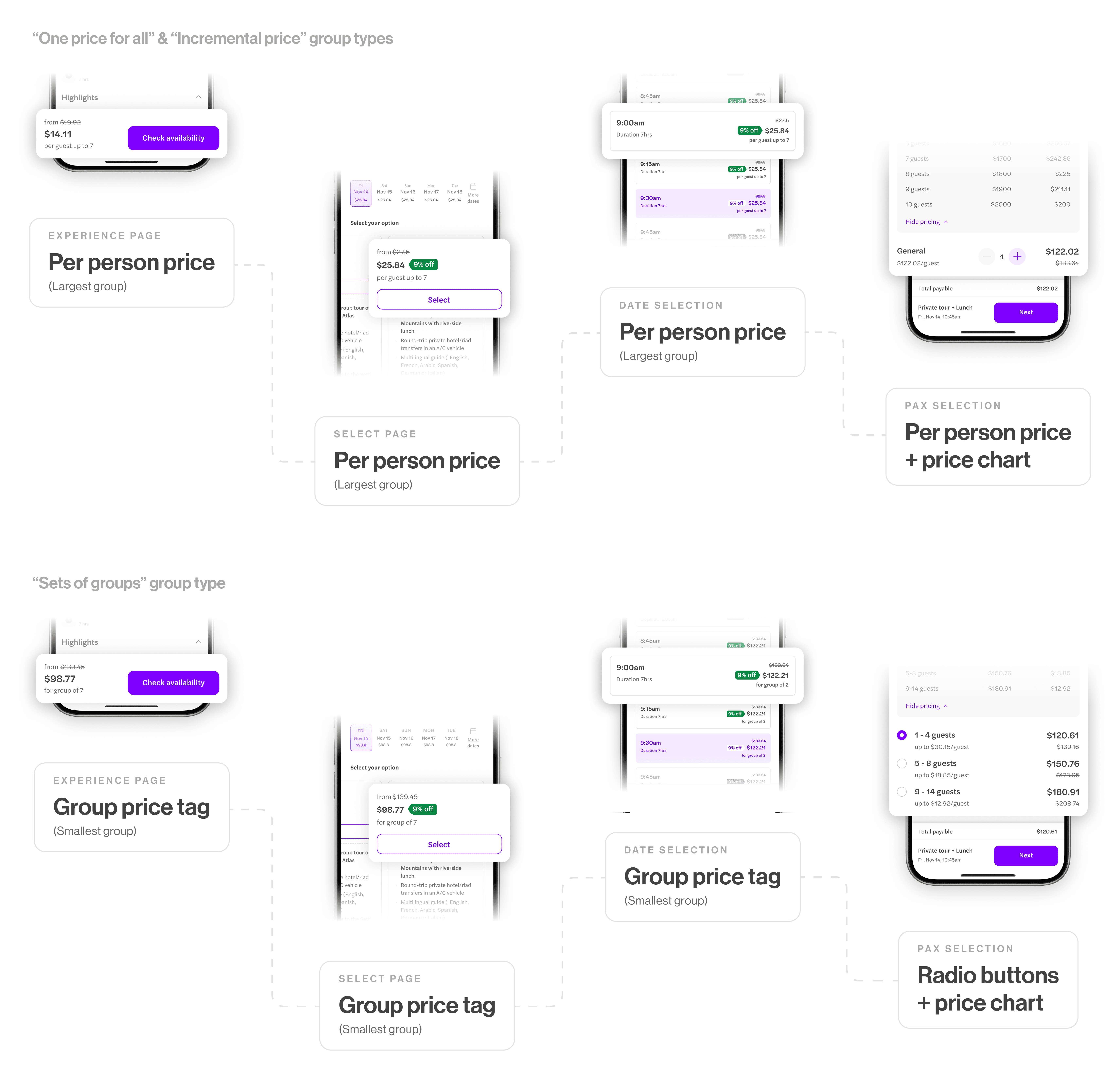

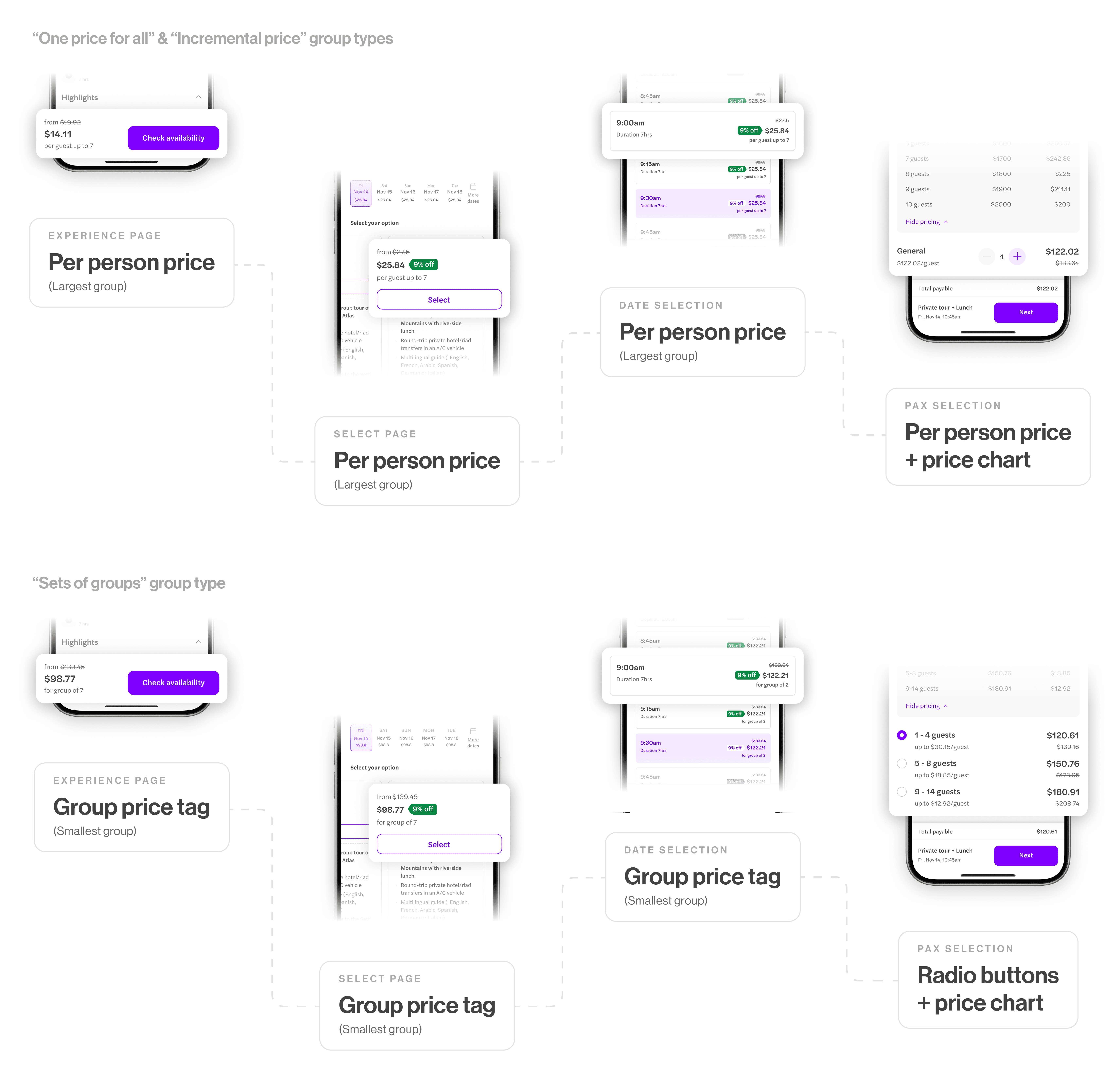

1. One price for all

In this group type, no matter how many pax the user selects, it is not going to change the price, and a cap is set for the max number of people.

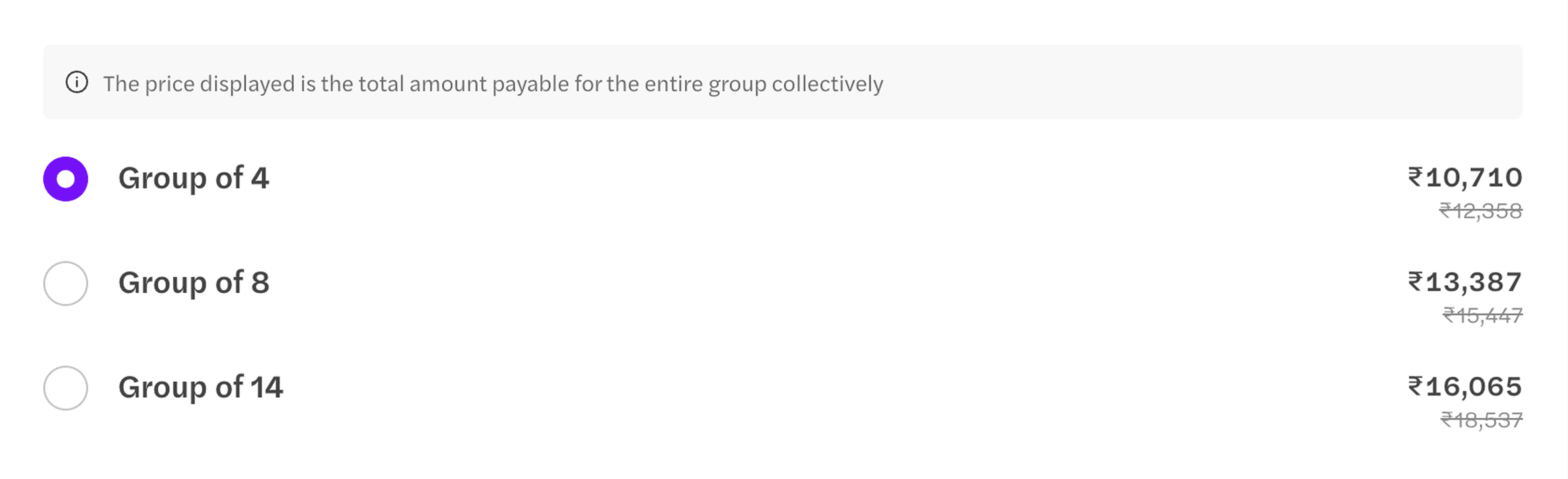

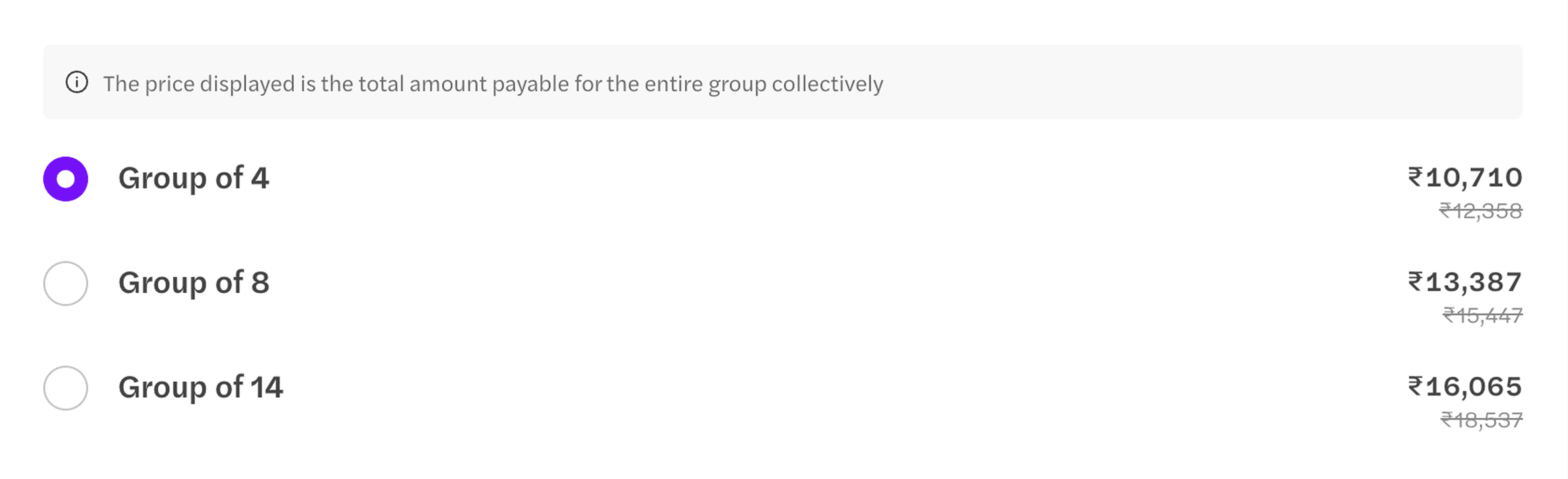

2. Sets of groups

In this group type, groups are divided in sets, like 1-4 pax, 5-8 pax, etc... In this case, the price will be constant up to the given number in the set, and goes up for each set.

3. Price increments

In this group type, as the number of pax increases, there is a small increment in the total price, which leads to a drop in the per pax cost.

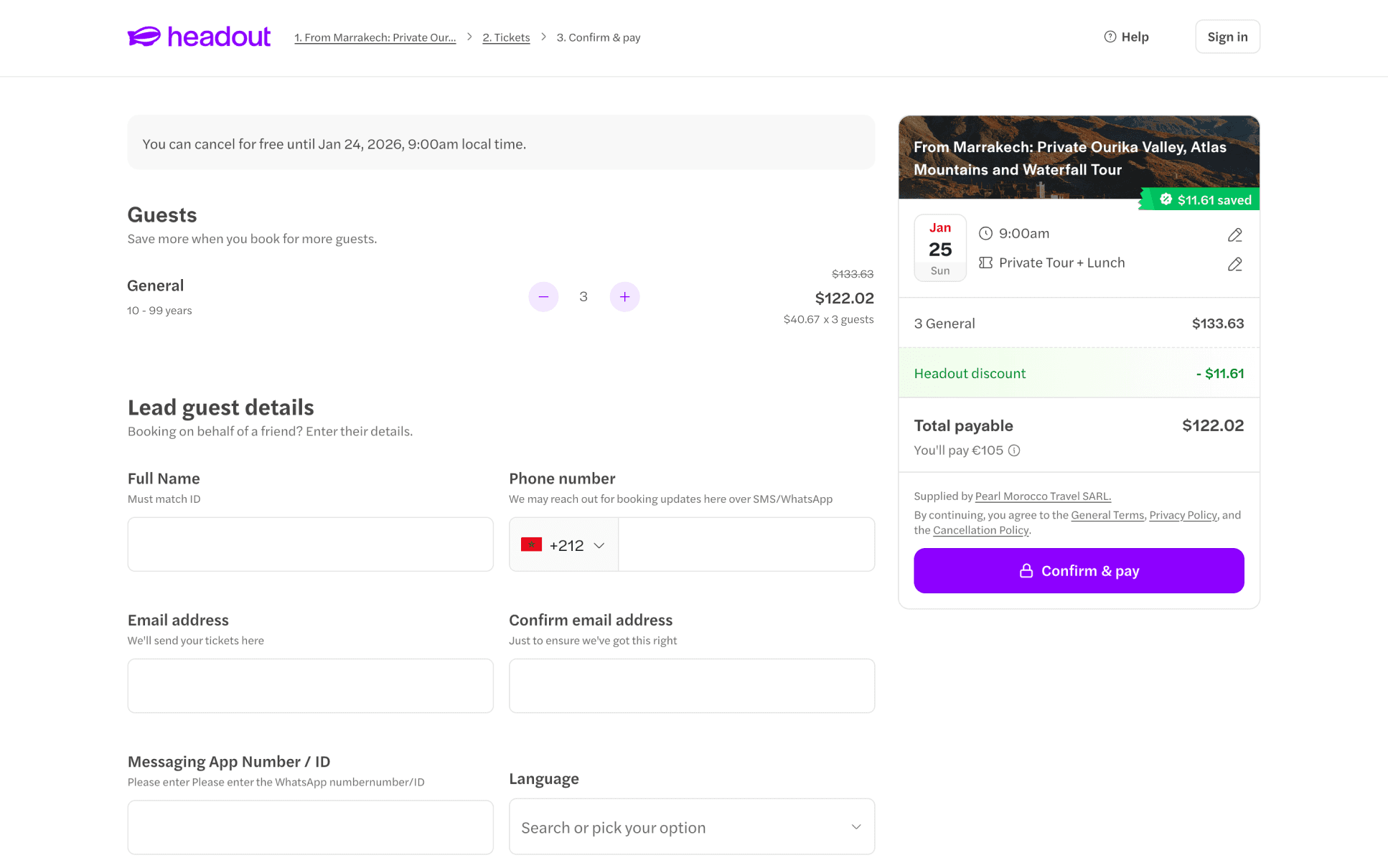

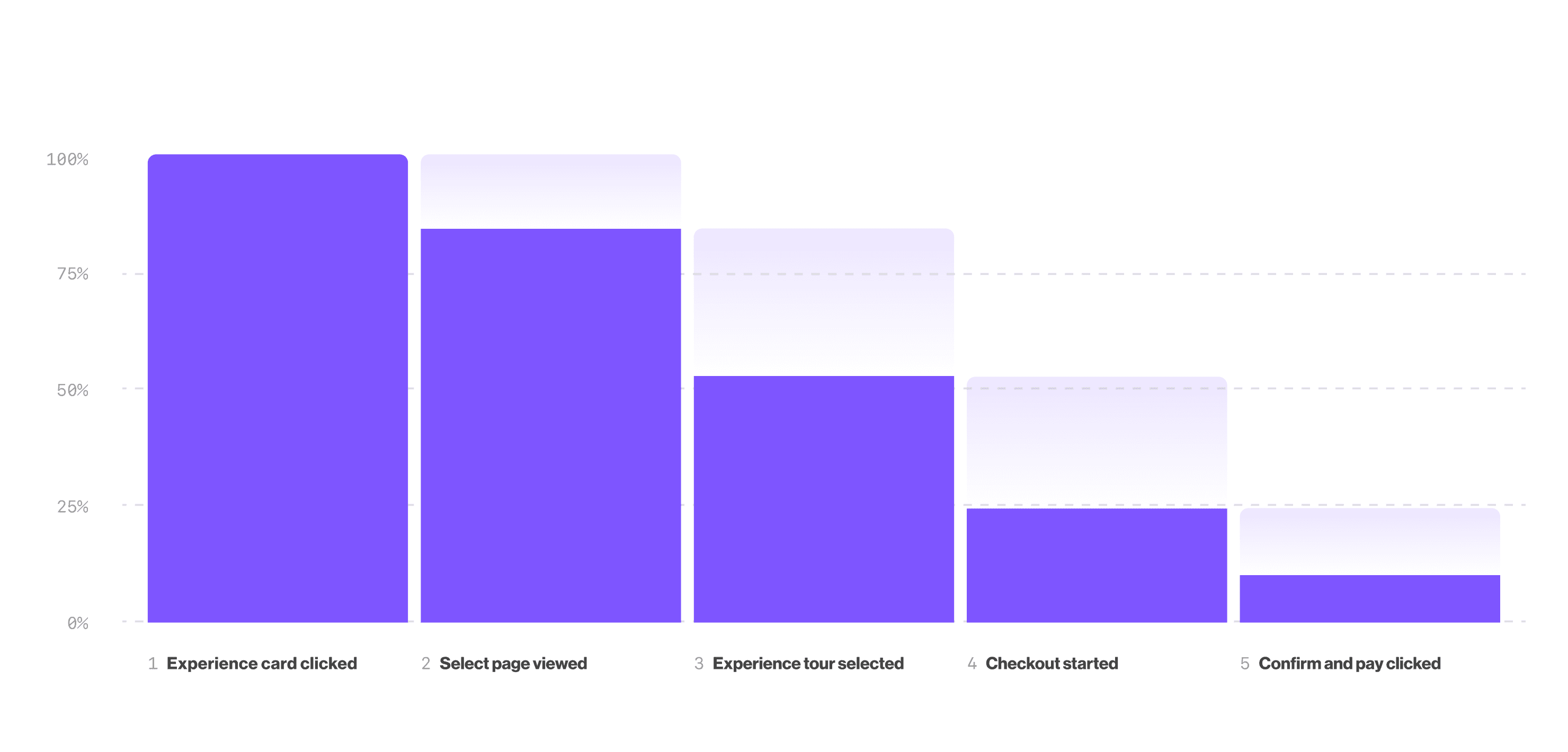

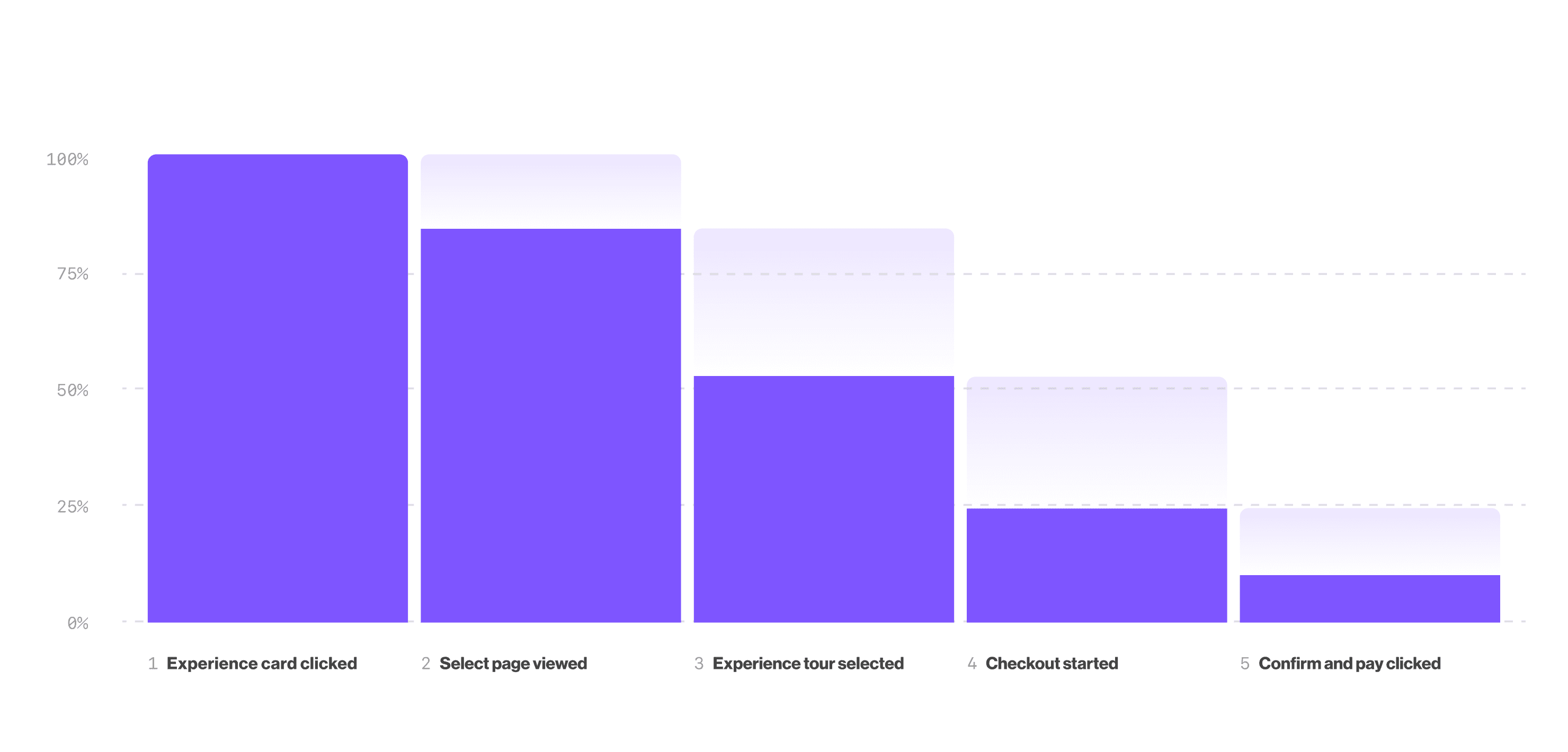

We figured that the Group bookings' overall conversion was roughly 20 times less compared to the General bookings.

The root cause.

People want to know how much the experience costs them, and don’t care about whether it’s a group or not.

But...

The current group pricing was too constrained and unclear, and people thought that the tours were overpriced and missed on the savings, which dorpped the CVRs.

Group based pricing division

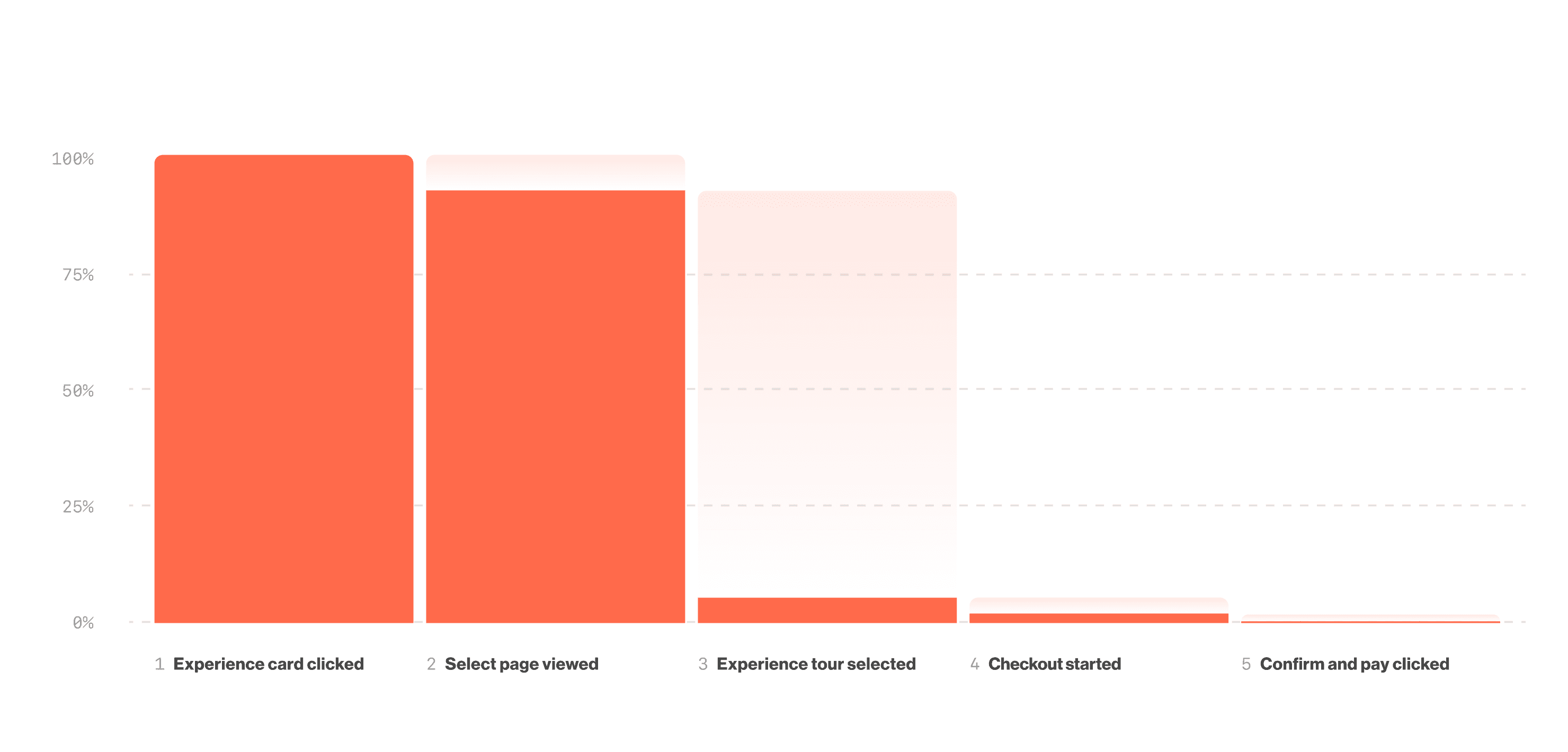

General booking - visitor to order flow conversion

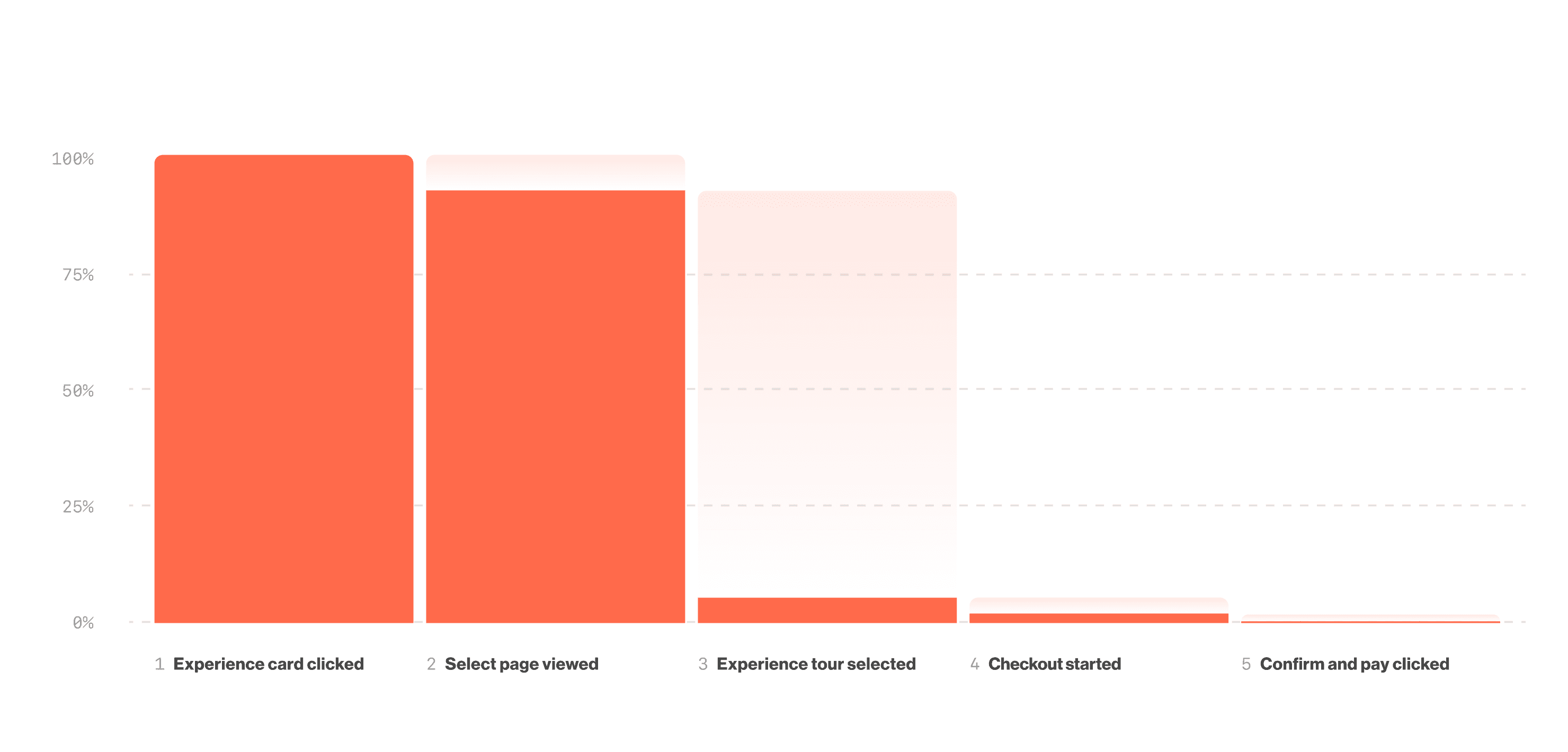

Group booking - visitor to order flow conversion

Hypothesis

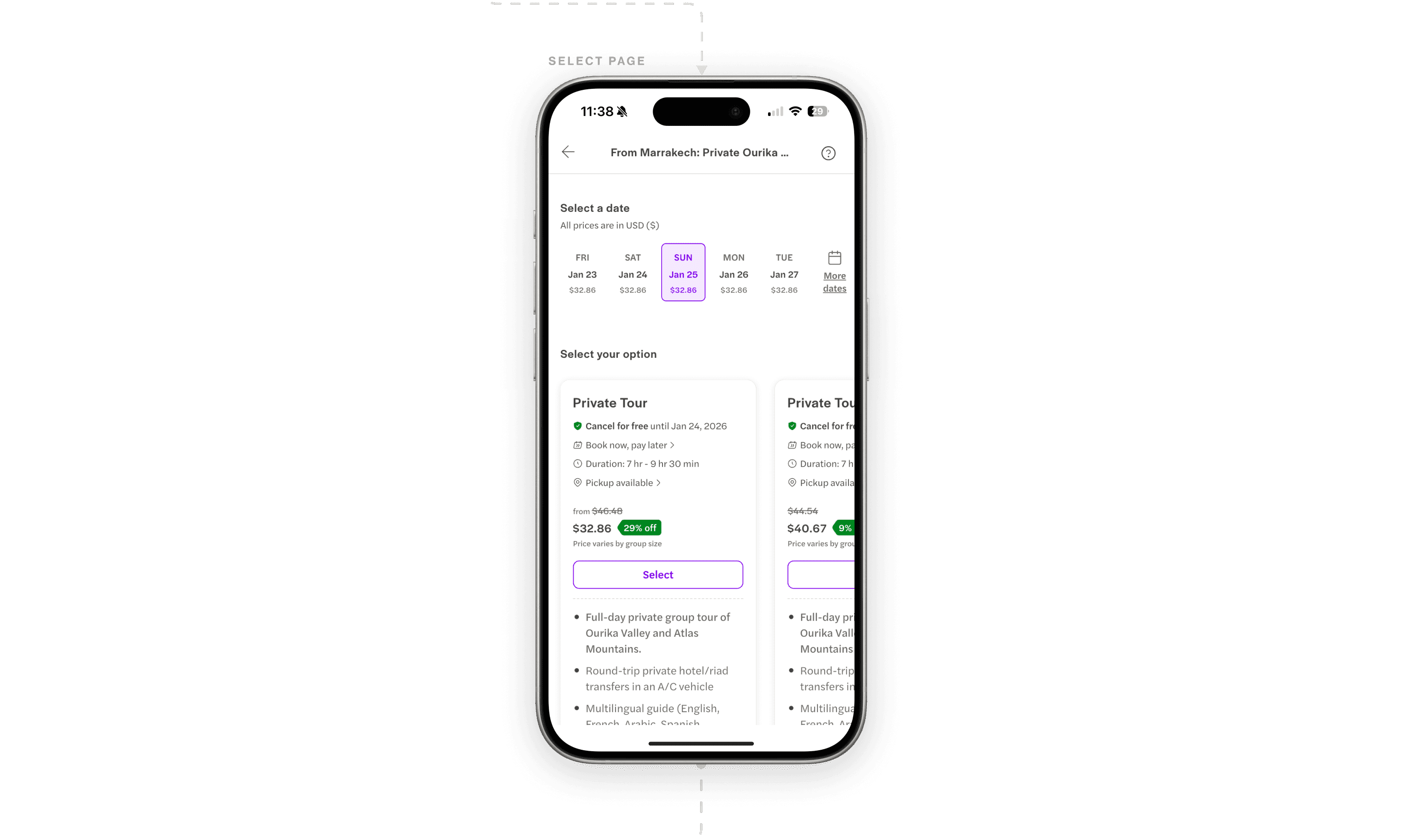

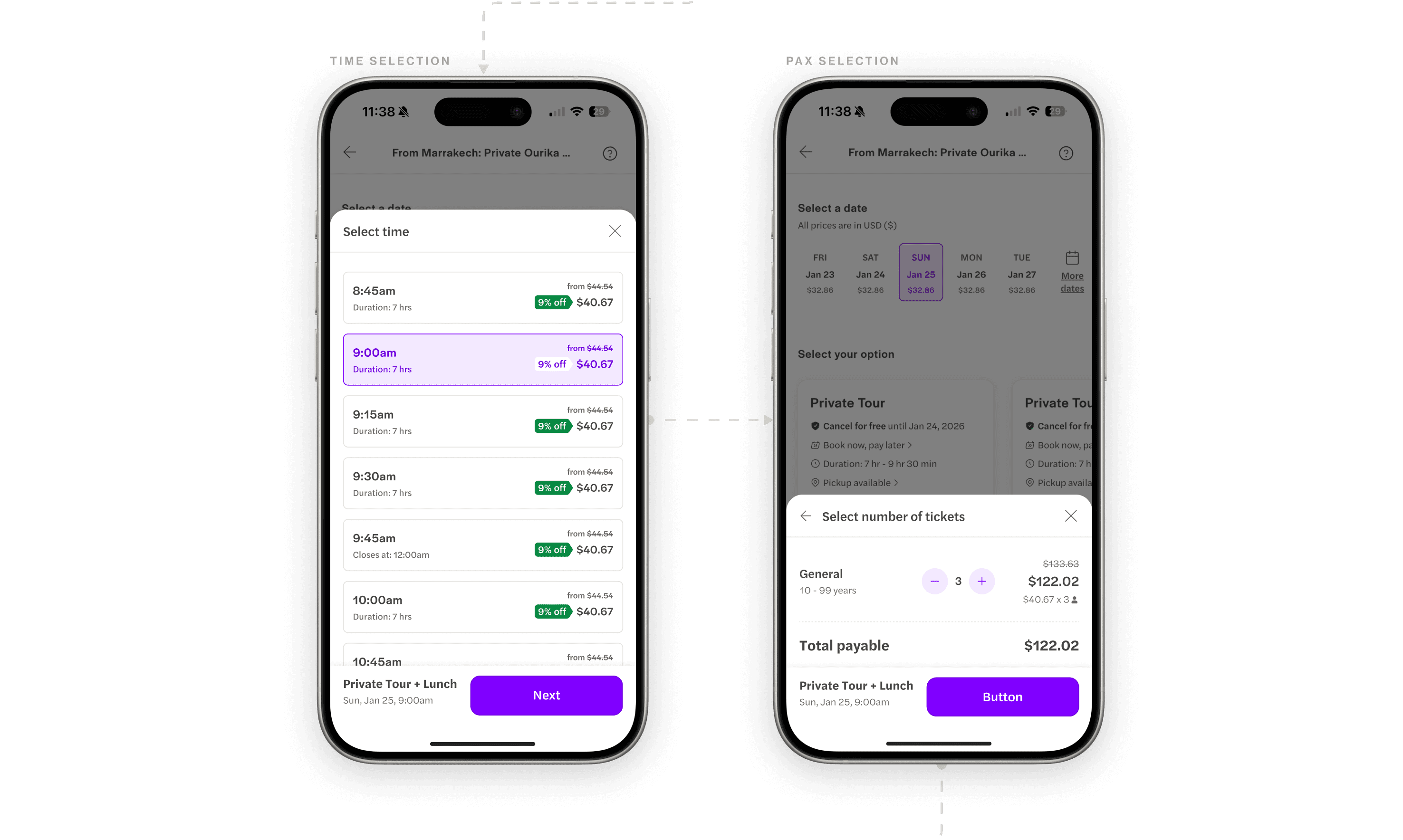

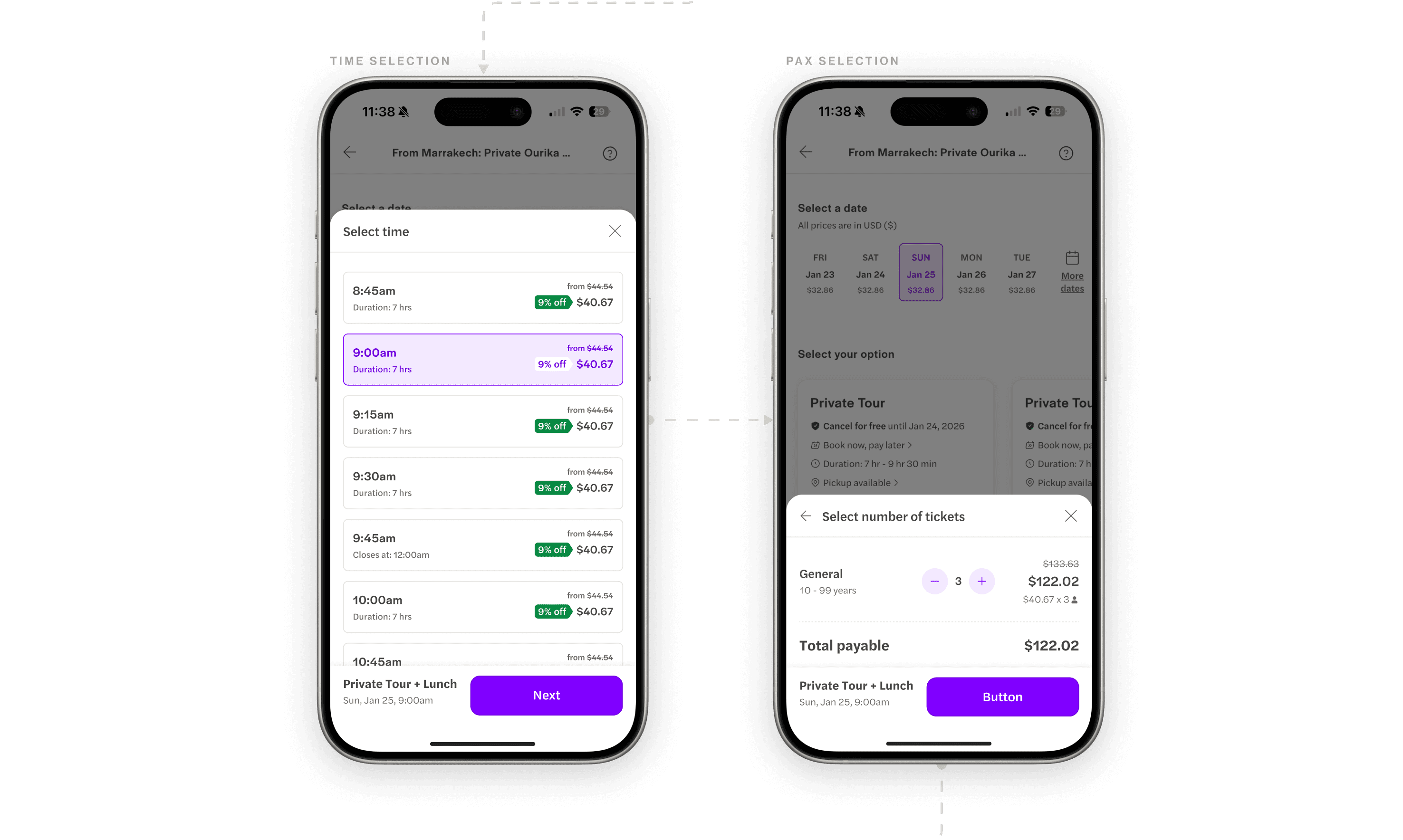

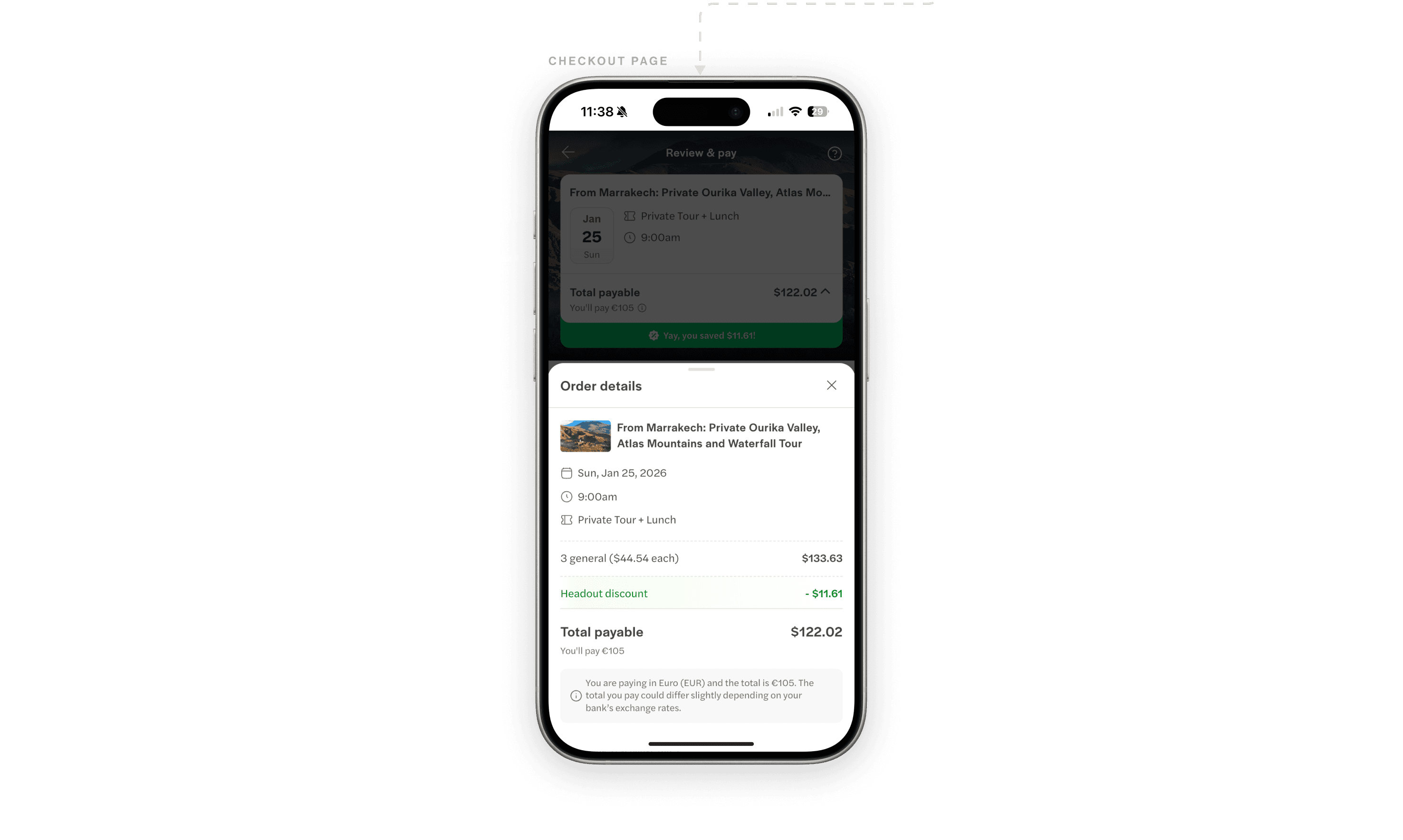

We observed a significant dip after the Select Page because our pricing hierarchy fails the comparison test. By showing group totals against competitors' per-head rates, we had created a false perception of high cost.

Brainstooooorming.

After roughly two weeks of ideations for the pricing logic, we came up with roughly 20 different ideations, and picked the 3 major ones that made the most sense.

Brain storming session with the PM (& my mentor)

01. Unified pricing

The thought

People are educated about the group pricing from the get-go. This allows them to make an informed decision. But, it hinders the business, as the price still looks inflated & the users are expected to do all the math (Confirmed with past experimentation).

02. 2 Different Approaches

The thought

The group price was kept consistent across both concepts to maintain the pricing as displayed at the checkout page. But the usability test confirmed that this was perceived as an overload of information & instead of helping the user make informed decision, it increased confusions.

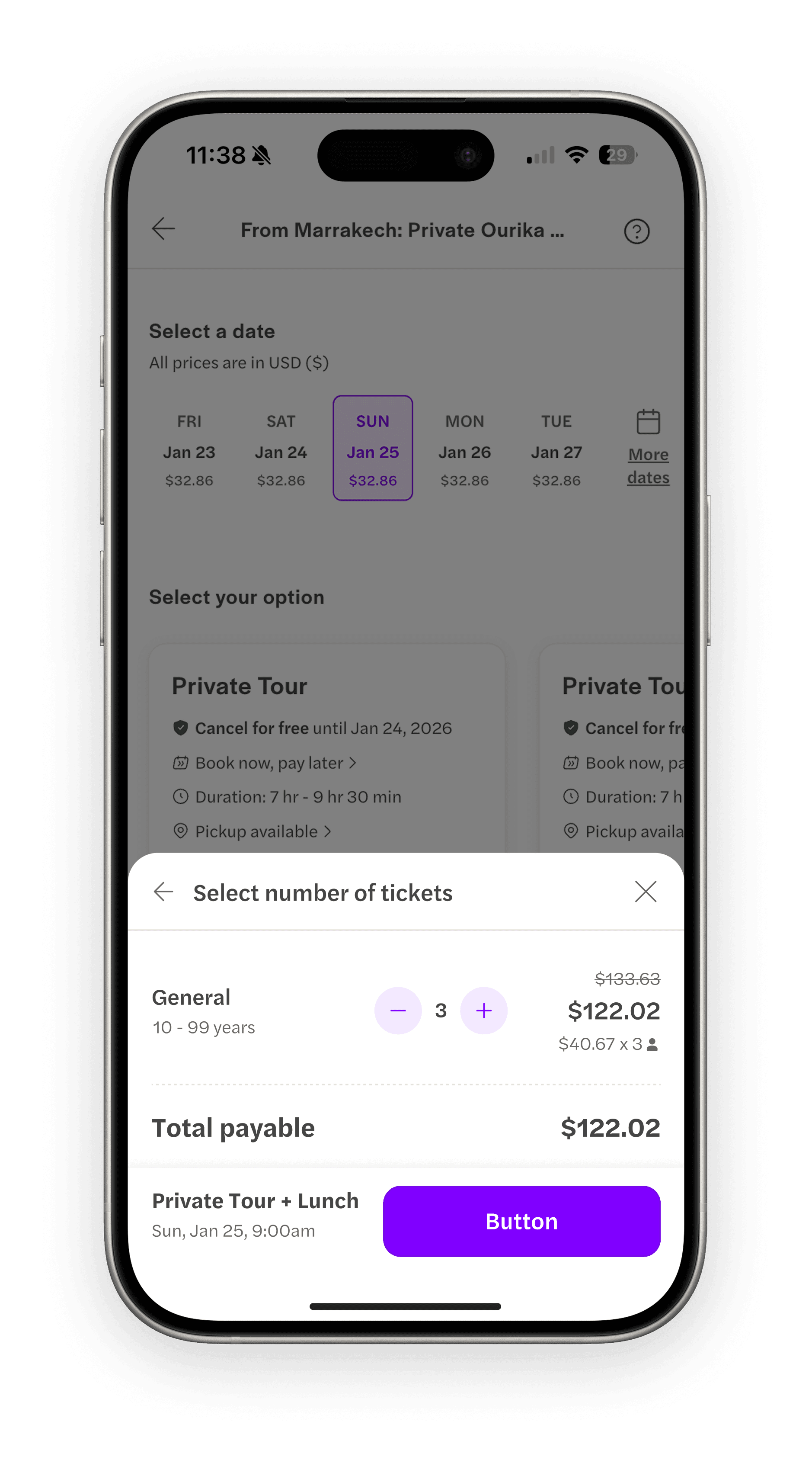

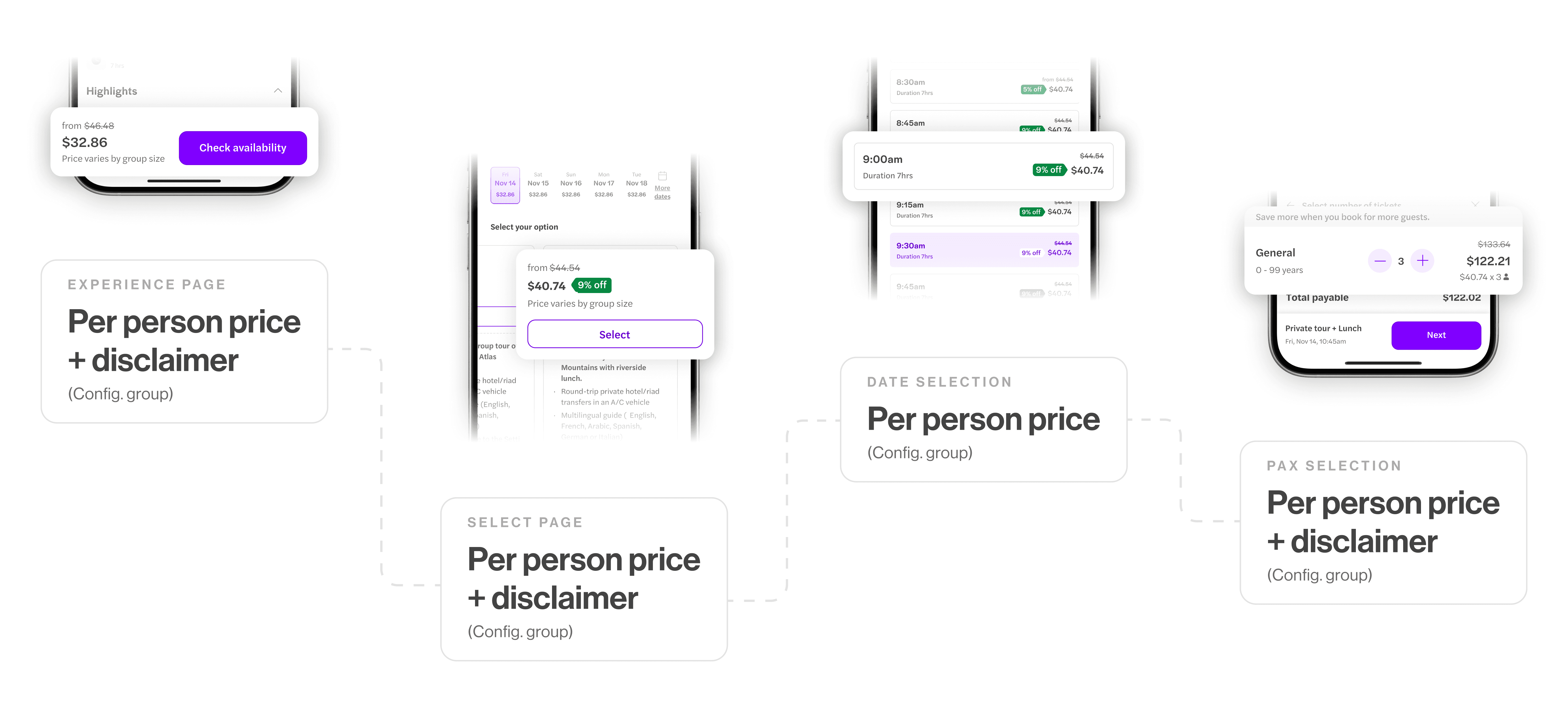

03. Unified pricing + Configurable number

Configurable number

It is the most frequently booked number of tickets for a particular experience. This number is defaulted at 3, since that is the most common number of bookings for these group experiences. This number is edited by Catalogue team/BDMs based on the market.

The thought

All the noise and overload of info. was removed, but still ensured that the users have a disclaimer about the group pricing model. Per guest price was shown across, to maintain consistency with other Headout experiences, since it was proven to be the most efficient (past experiment).

We finalized on Config. Number

The reasoning

While the other ideations solved for the purpose, user testing revealed that aggregate costs caused sticker shock and forced mental math. We prioritized UX over engineering effort, restructuring the backend to display accurate per-person pricing upfront to reduce cognitive load.

User effort

Information overload

Dev. Effort

Competitor solution

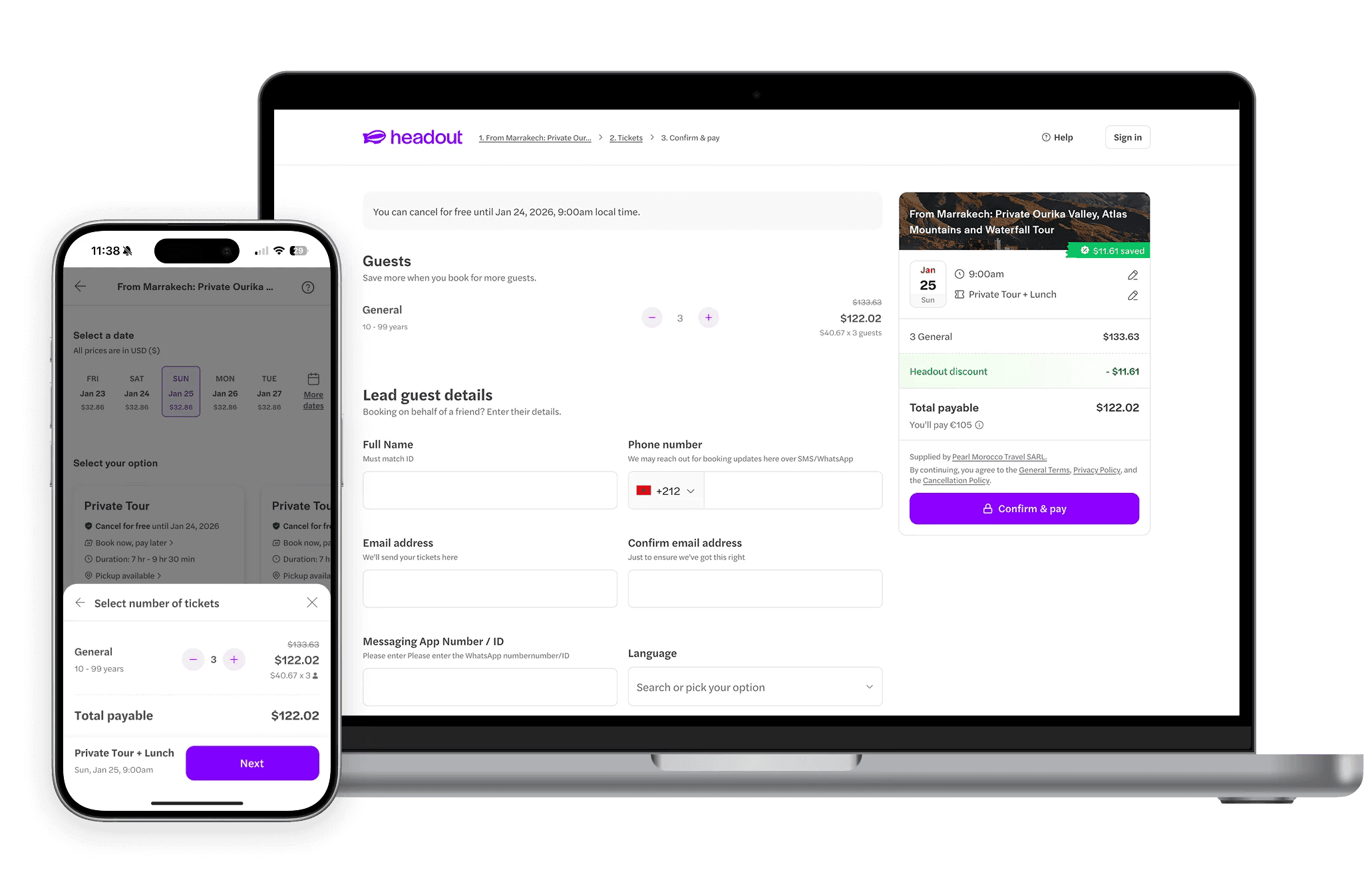

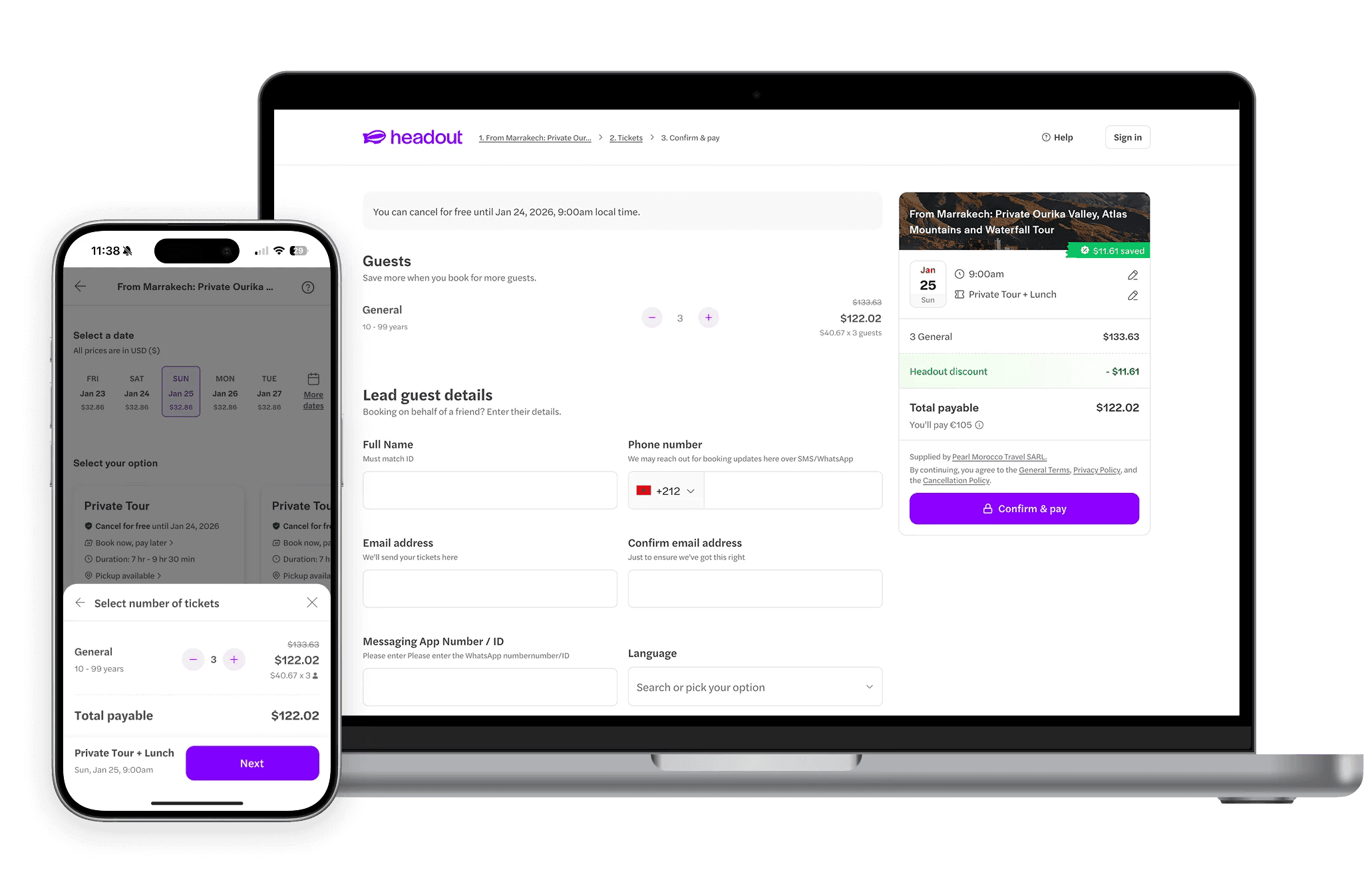

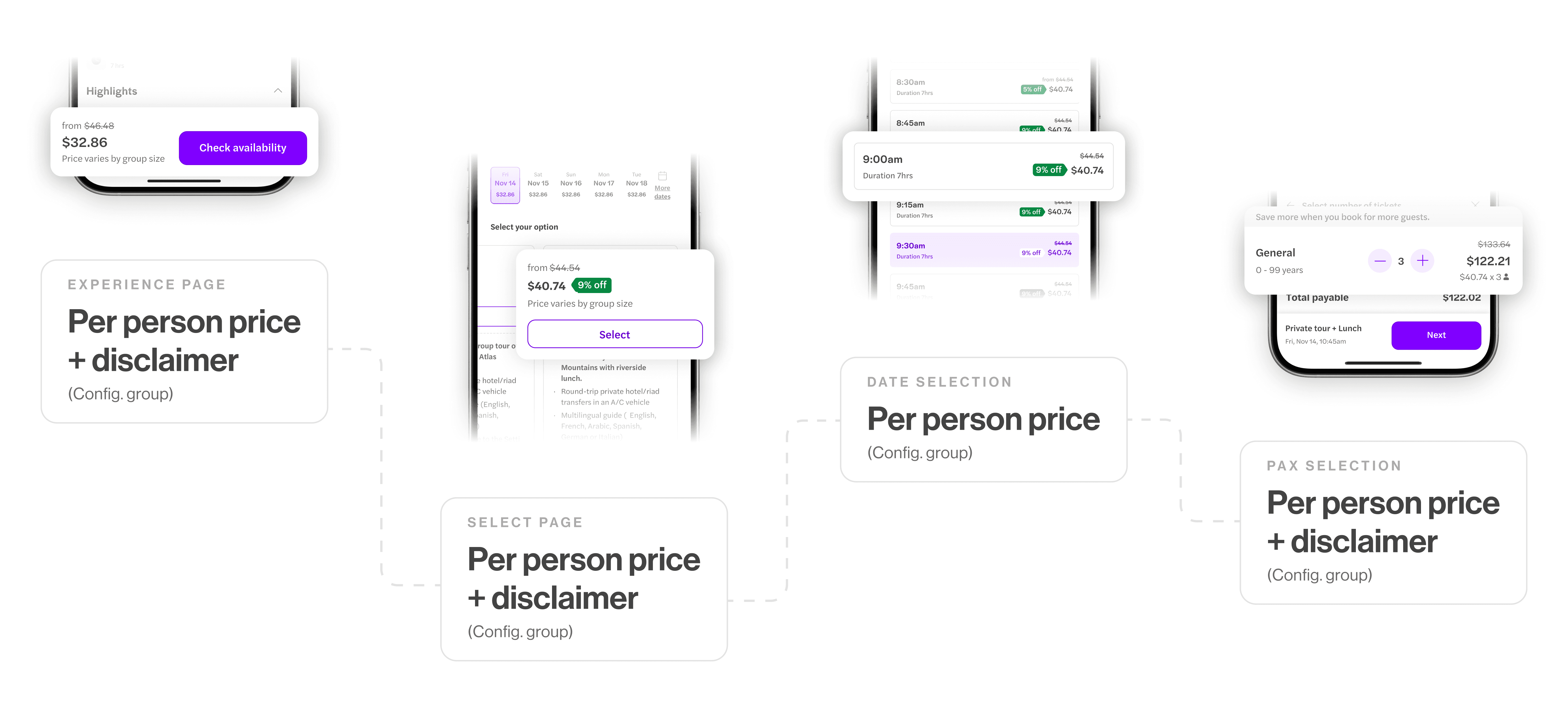

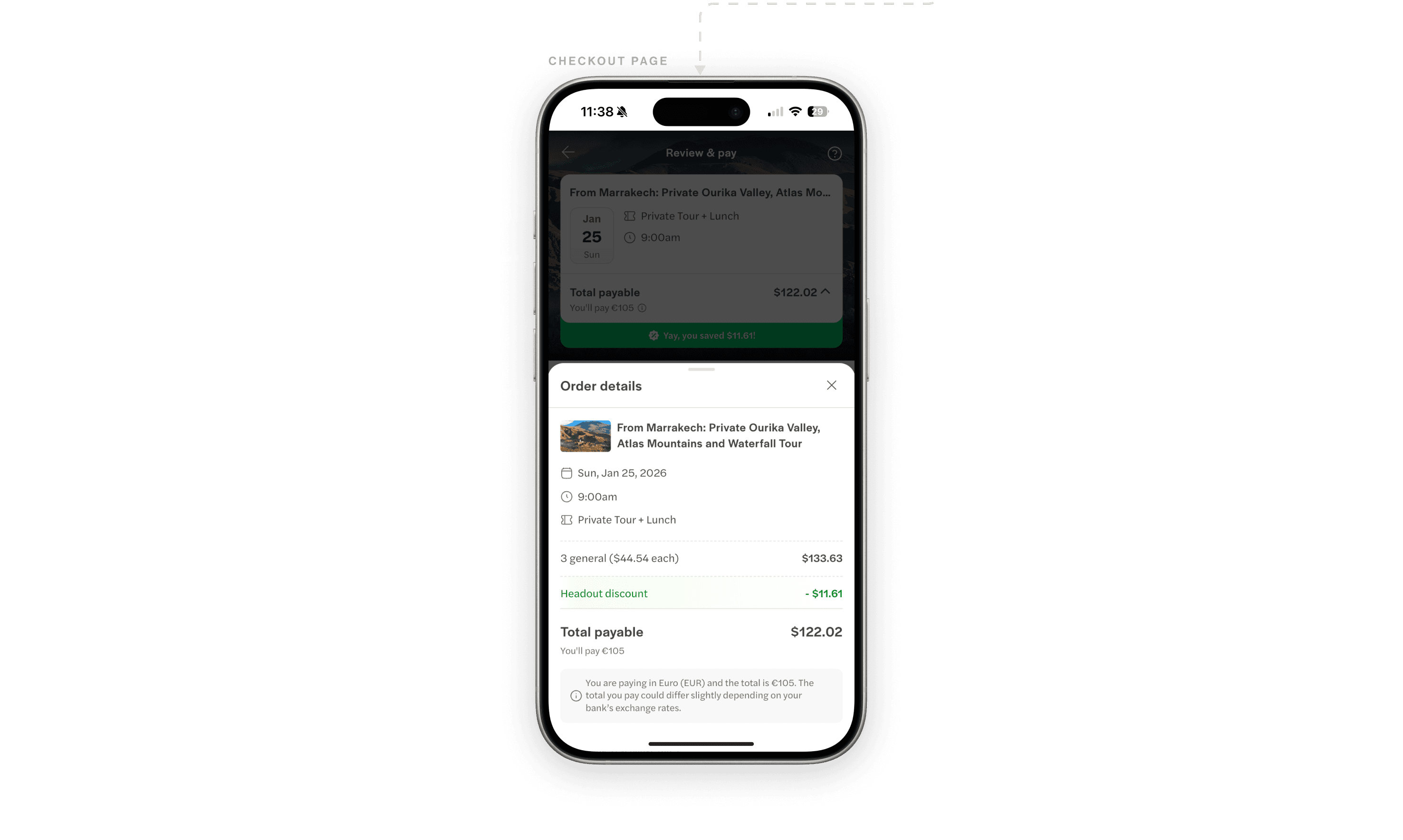

Select to Checkout flow

Product listing tool

Product ranking

Visual explorations.

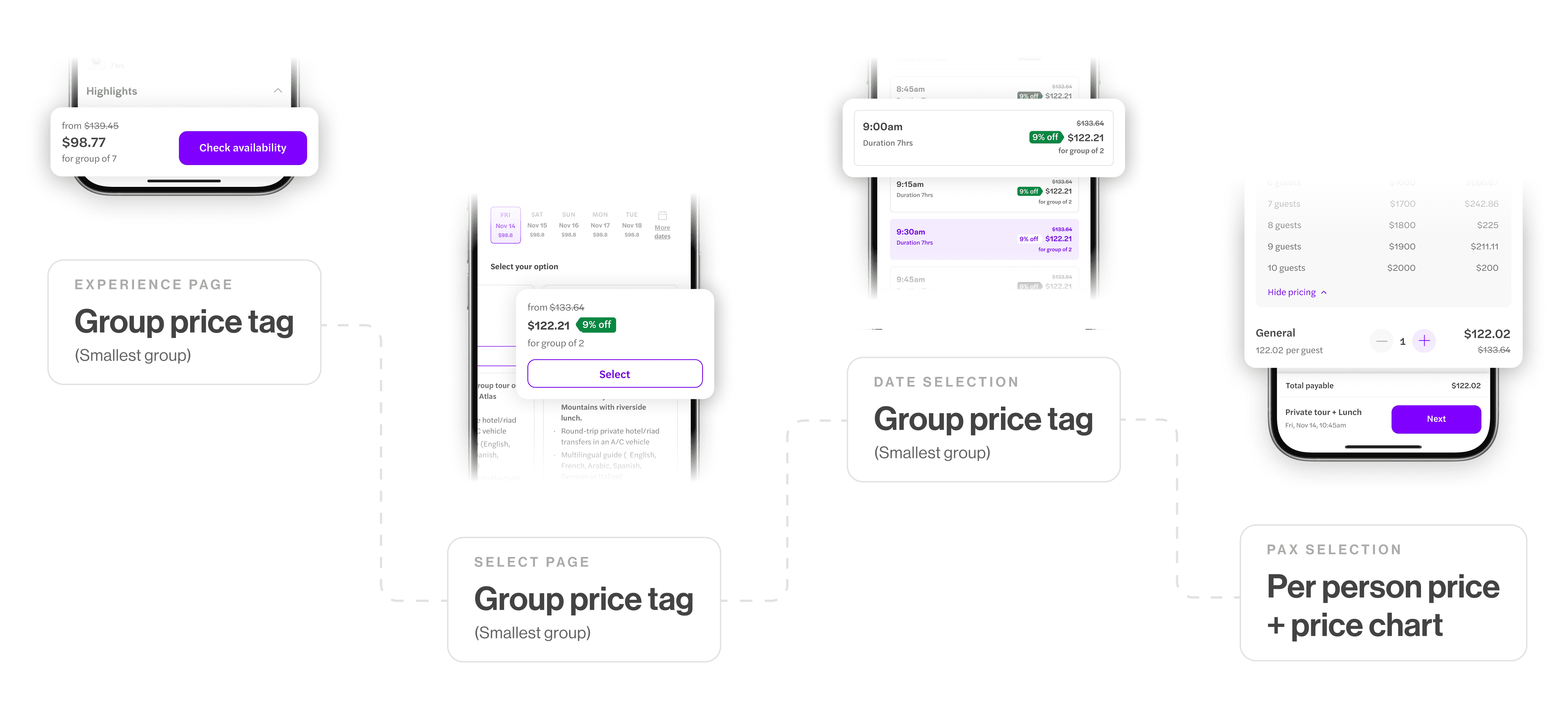

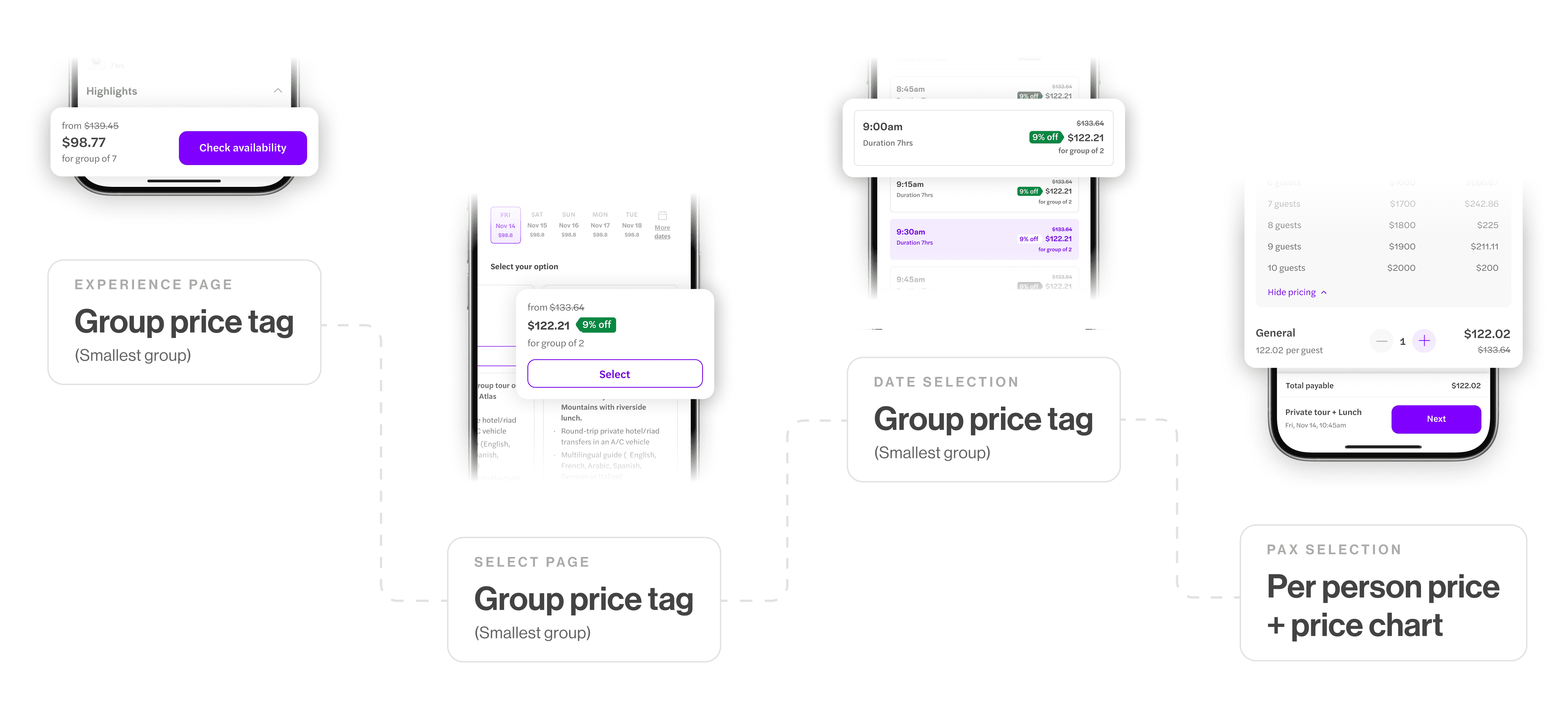

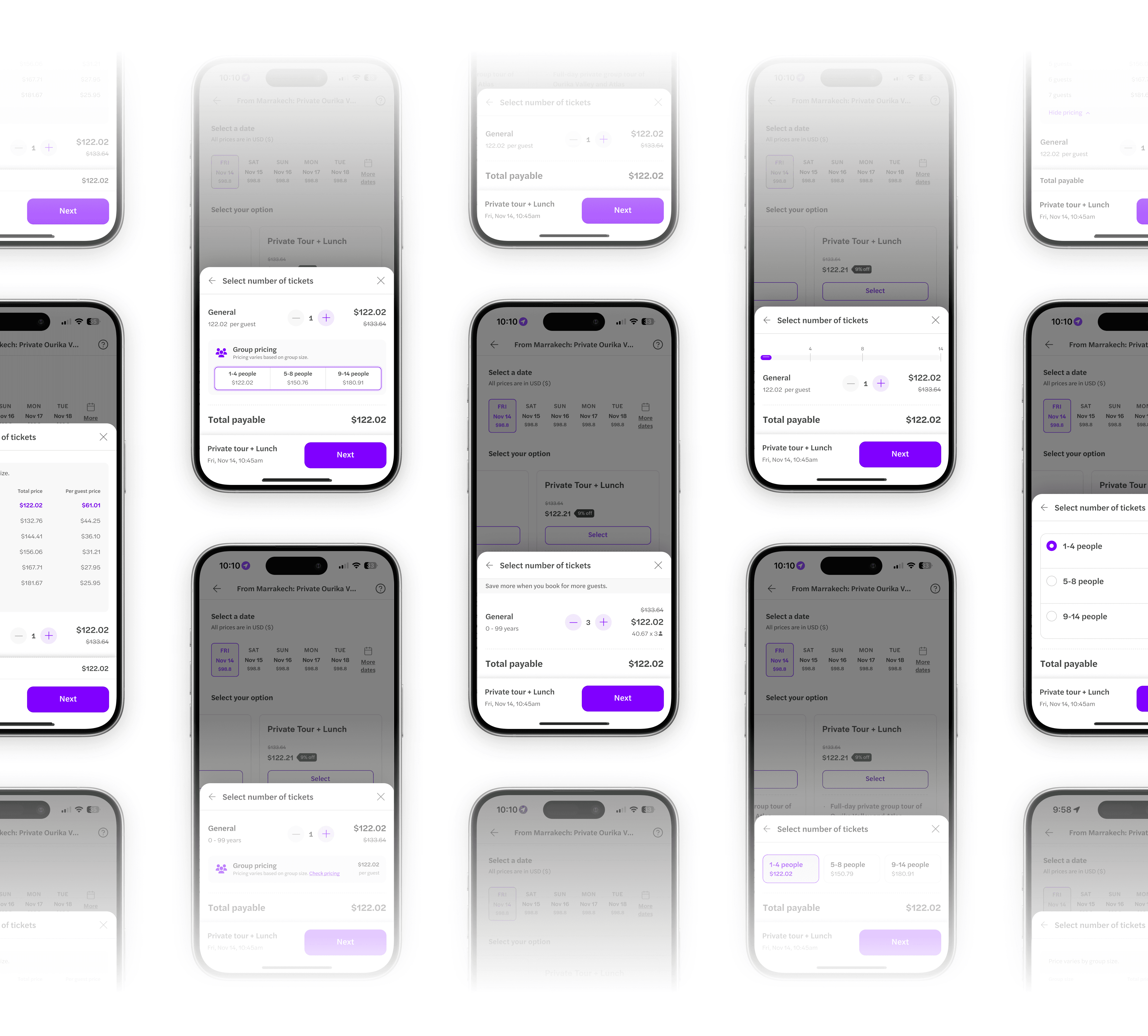

Final flows.

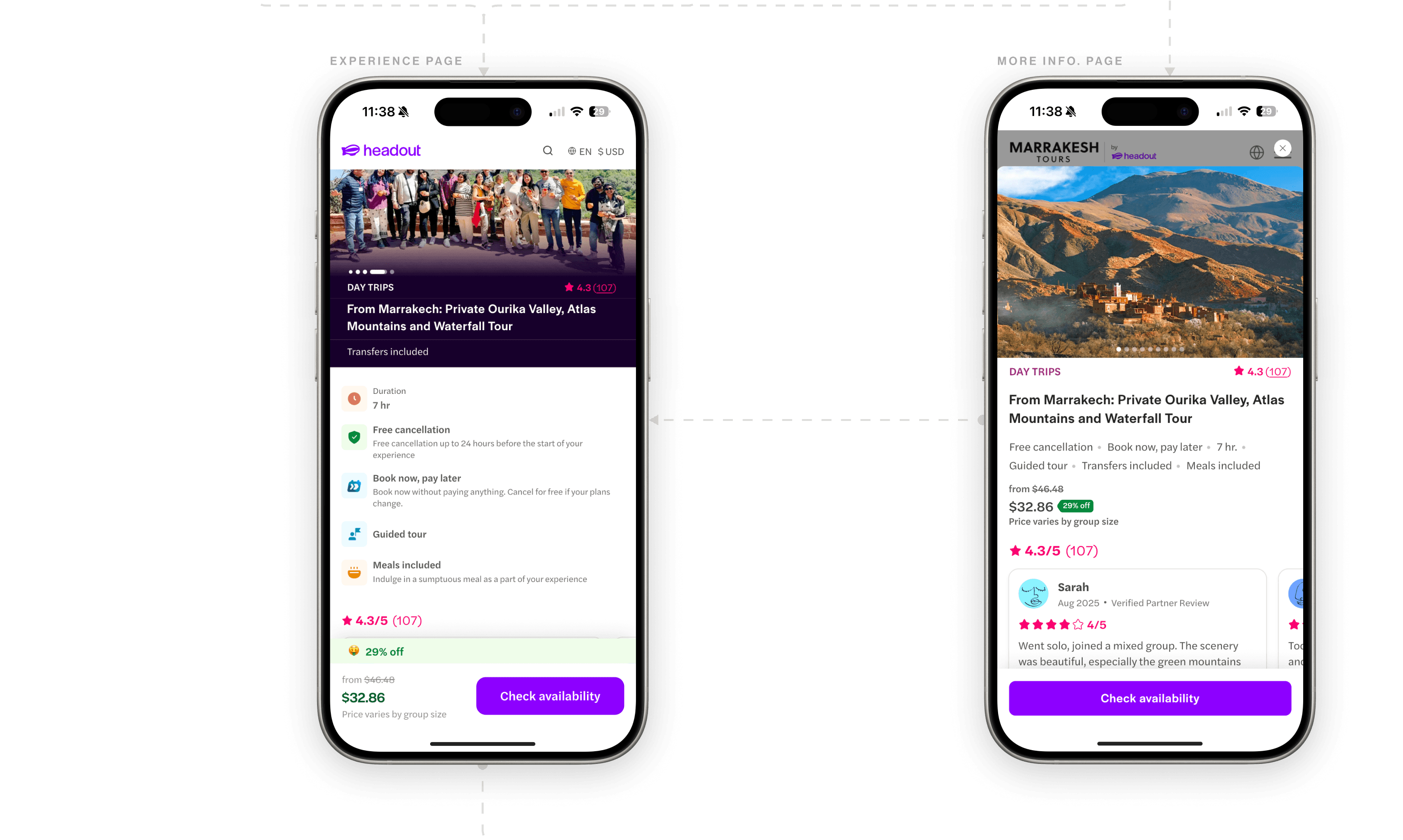

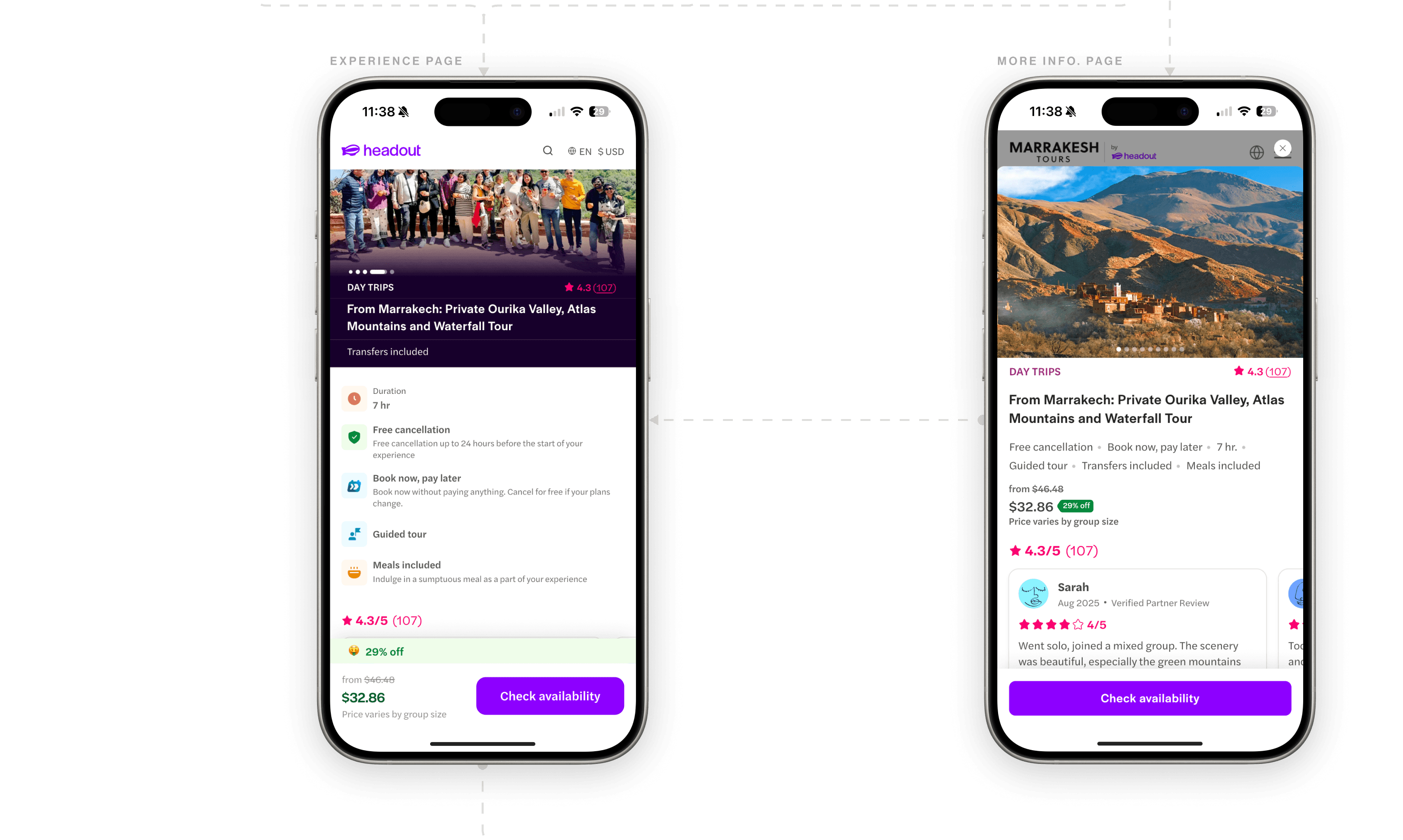

The flow covers all the touch-points in the Headout app and website which are affected by the group pricing.

Glossory

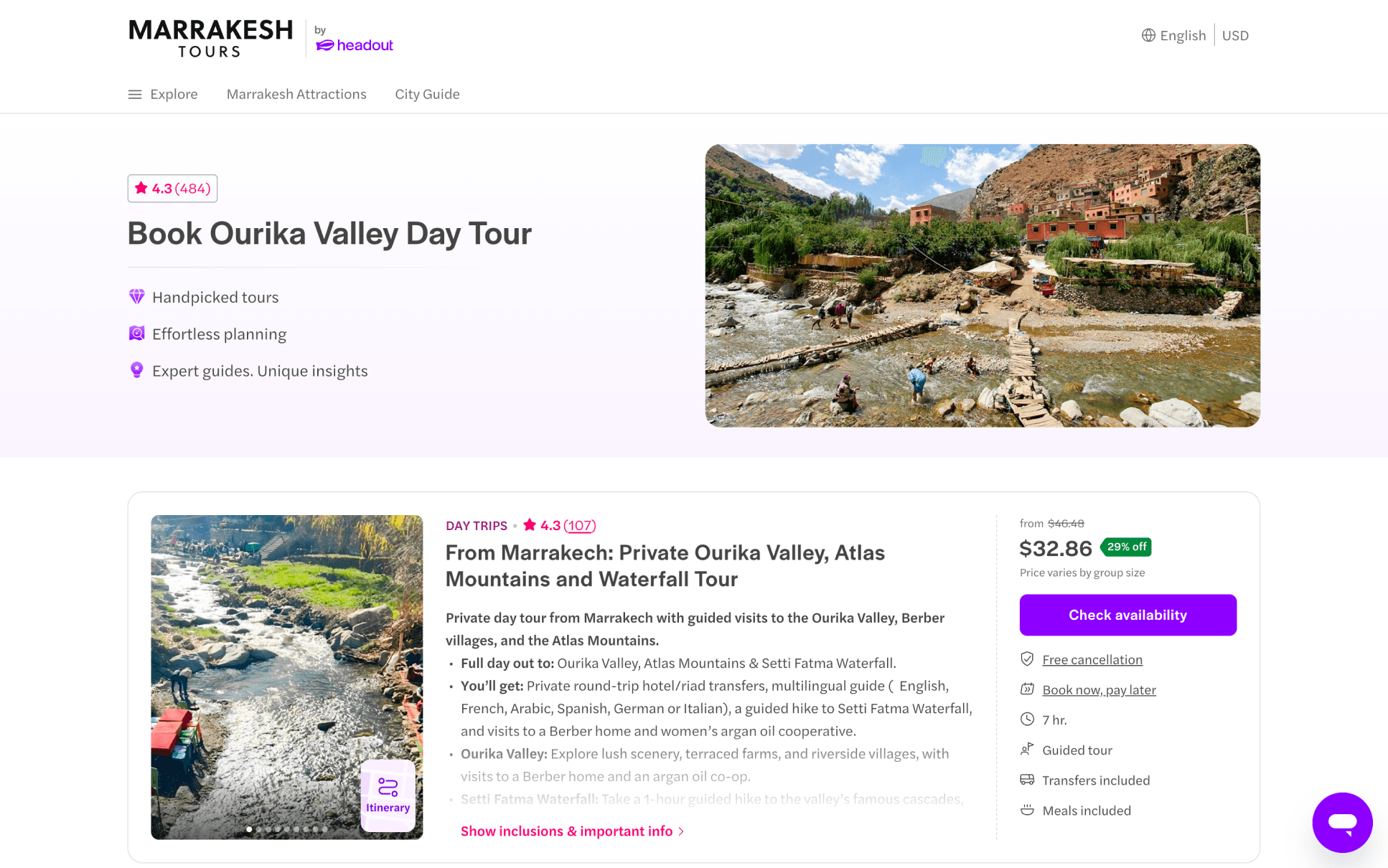

City/Collection pages: A city page is a set of collection pages, and experiences that belong to a particular city. Similarly, a collection page, is a set of similar experiences for a particular location/tourist spot. Ex: A collection page for Eiffel tower inside the Paris city page.

Micro-Brand(MB) pages: MB pages are separate branded pages, to rank higher in the SEO. These MB pages are usually made for Cities or collections so that it can catch keywords. Each MB page has its own domain, relating to the name of the location, to make it feel more reliable.

Ex: www.thevaticantickets.com.

Most of Headout's bookings currently come through these MB pages.

Desktop designs.

Major considerations.

The designs ensured that they adhere to the dev and listing constraints and still be able to achieve the intended purpose

API data

API data

Bookings are categorized as either “Per person” or “Per group” in the API. The design ensured that it used data that was already included in the API such as pax count, per person price etc... minimizing developer edits.

Internal tools

Internal tools

Headout currently uses an internal tool for the Catalogue team called Scorpio, which they use to list the products submitted by the vendors. A new section was to be added in Scorpio to enter the configurable number.

Product ranking

Product ranking

86.4% of Headout’s group bookings are a combination of “per person” and “per group” type products, hence showing the “per person” price upfront ensures current product rankings remain unchanged.

Weaker currencies

Weaker currencies

The design was made using the weakest currency Headout listed, i.e Lebanese Pound (LBP), for the most expensive tour which had an 8 digit amount.

Localization

Localization

Headout translates the site into 9 languages, and some of them have longer texts, for ex. French has a longer text for the discount price tag.

Impact.

The solution is currently being developed for experimentation hence no results to document, but here are the success metrics

Even after the project is completed, this data will not be disclosed publicly for confidentiality.

Business metrics

Select to Checkout (S2C)

Checkout to Orders (C2O)

Click-Through Rate (CTR)

My biggest learning

A redesign to improve the experience doesn’t necessarily have to be design-heavy major overhaul. Minor tweaks in the design, with the right intent could also move major milestones and improve the overall experience.